SINGAPORE AND REGIONAL stocks enjoyed a strong recovery last week but ….. there is more bad news to come out of the eurozone debt crisis in the coming months, according to Kevin Scully, the executive chairman of NRA Capital.

As a result, the Singapore market will continue to be volatile and range bound with a downward bias until the end of 2011, said Kevin at the Invest Insight Seminar held at the Rock Auditorium on Saturday (Oct 15).

Kevin expects the STI Index, currently at 2,744, to find support at 2500 and, if that breaks, then 2200.

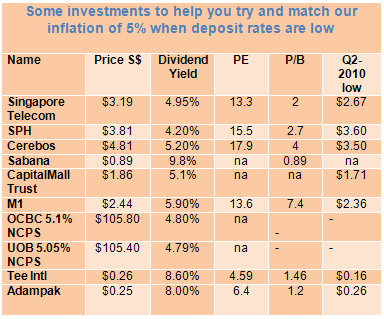

“If you cannot stomach the volatility, you should reduce your weightings in cyclicals into any rally and move into defensive yield plays.” (see table below)

Kevin added that investors who are prepared to wait one to two years can expect to make good gains in both blue chips and mid/small caps. His blue chip stock picks:

- Singapore Telecom – accumulate at $3.00

- SPH – accumulate at $3.60

- OCBC – accumulate at $8.00

- SGX – accumulate at $6.00

- Keppel Corp – accumulate at $7.50

- Olam – accumulate at $2.20

On why, investors can expect more bad news from the eurozone, Kevin said the European Financial Stability Facility is too small - at euro 780bn, it can save Greece and maybe Portugal but not Italy, Spain, Ireland and even France.

In addition, eurozone governments would not be able to keep to their promised fiscal cuts in the face of strong social unrest.

It would be difficult to save European banks that hold euro sovereign debt. “I think we could see at least 10 European bank failures over the next one to two years,” reckoned Kevin.

Markets have been very volatile since August 2011. “Expect that to continue - it would take about 4 months for markets to stabilize,” said Kevin.

“I expect the volatility to continue into November/December 2011….or until we have a sovereign default or more bank defaults – we can then see the impact of the defaults instead of trying to guess their impact."

For the full set of powerpoint slides from Kevin's presentation, go to www.nracapital.com

Recent story: Market Slide Continues, but Positives May Be on the Horizon

My own gut feel is that the ship is turning. Consider that European Union Economic and Monetary Affairs Commissioner said clarity on a plan to contain the region’s debt crisis will emerge in the “coming days”. This is quite a big promise, isn't it? The big ship is turning.

G-20 countries have held out the prospect of giving more International Monetary Fund aid to Europe. Cheers guys!