Excerpts from latest analyst reports....

AmFraser initiates coverage of YANGZIJIANG with a 'buy' call, $1.60 fair value

Analyst: Lee Yue Jer

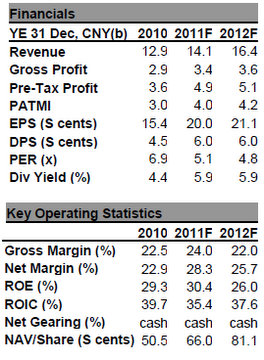

We initiate coverage on Yangzijiang Shipbuilding (YZJ) with a BUY and a fair value of $1.60. We believe that YZJ reached a significant milestone when it won the Seaspan order over South Korean yards—while bidding 5% higher. This fundamental shift in the competitive landscape has yet to be priced in.

In our opinion, the stock price has already taken into consideration the weak demand expectations and general fears about S-chip corporate governance. Put bluntly, not every S-chip is a bad egg. Over time, these fears should recede and allow for revaluation. BUY.

Potential catalysts:

* Exercise of Seaspan options and/or Peter Dohle Letter Of Intent (LOI)

* Investor reassessment of actual risks in Held-To-Maturity assets being much lower than currently perceived

INVESTMENT MERITS

* Fundamental shift in competitive landscape: YZJ is the only Chinese yard to win contracts for 10,000 TEU vessels over South Korean builders, and did so bidding at a 5% premium

* High quality at lowest costs: YZJ’s gross margin is 22% versus the industry average of 15%, an extremely strong advantage

* Strong order book provides earnings visibility up to 2014: Including the US$2.6b worth of options and LOI, YZJ can maintain its record profits up till at least 2014

* Held-to-maturity assets protect purchasing power of YZJ‟s cash and increases dividends: With inflation at 6% and deposit rates at 3.5%, YZJ needs to invest its cash. Investment returns also increase dividends by 8-10% by our calculations

NextInsight file photo.

* Clear dividend policy, attractive yield: Unlike many other companies, YZJ has a black-and-white dividend policy to pay at least 20% of profits. It has outdone itself by paying 30% in recent years. We forecast increased dividends to 6.0c—a good 6% yield

KEY RISKS

* Weakness in shipping markets: New orders have slowed, but not stopped. We see a refocus towards containerships over bulkers, which raises execution risks especially at the 10,000TEU+ range

* Normalizing gross margins to plateau near-term profits: With fewer high-margin pre-crisis orders, combined with high input-price inflation, gross margins should fall to normal levels. We foresee a flat earnings outlook, but at the record highs

* HTM assets at risk in hard-landing scenario: Though strongly covered by collateral, a hard-landing scenario in China may delay value recovery. We do not see large losses even should this happen.

Recent story: S-CHIPS: What analysts now say after 2Q results....

Kim Eng Research lowers rating on MARCO POLO to 'hold'

Analyst: Eric Ong

Marco Polo Marine’s (MPM) share price has risen by about 20% from its low of $0.32 last month, buoyed by a slew of new order wins and regulatory approval for its offering of Taiwan Depositary Receipts. The TDR issue will comprise 25m new shares and 26.19m vendor shares held by certain existing investors of the company.

Nevertheless, we downgrade the stock to HOLD given that it is currently trading near our newly‐revised target price of $0.44.

Goldman Sachs upgrades GENTING to 'buy'

Goldman Sachs analysts Paul Lian and June Zhu said the recent Genting (GENS) stock price pullback is making the counter attractive, adding that 2012 looks promising for the gaming company.

It cited four potential catalysts, advising investors to be less influenced by quarterly swings and be more focused on the following underlying trends:

(1) new VIP Suites/Villas (Dec 11/Feb 12) and additional gaming salons;

(2) improving ops leverage - GENS is fully staffed, thus the cost base is unlikely to grow much as revenues roll in;

(3) strong Free Cash Flow generation of S$1.3bn/1.5bn in 2011E/12E; GENS is already net cash - potential for dividend surprise;

(4) phased rollout of Junket licenses, not before 1H2012.

Recent story: GENTING, CWT, ARA: What analysts now say…