The following article by ethan999, posted yesterday on our NextInsight forum, is one of the best reader postings we have seen. It reflects the writer's insights into the reality of market dynamics and his compelling reasons for why he invests the way he does.

PERSONALLY, I never try to predict the market as a whole. There are far too many variables and unknowns involved in the market and these variables often have different degrees of effects on the stock market at different points in time.

The macro-economic picture is too complex and multi-faceted for any single individual or organization to be able to predict reliably more than 50% of the time over an extended period.

As individuals all we can do is focus on the fundamentals and financial ratios of individual stocks and ensure that we have enough cash to load up more of the companies which have fundamentals we believe in if and when the market goes down.

For example, people say that there are many problems in America and Europe. For Europe, fair enough - if you take a look at many European stock markets, they are close and some even below their March 2009 lows, meaning as low if not lower than the levels they reached during the bottom of the most severe recession since the Great Depression.

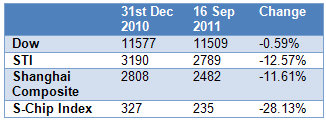

What about the Dow? Take a look at these stats (table on the right).

The Dow is essentially flat but Chinese and Singaporean stocks are down significantly?

Wait a minute, aren't all the problems in America and Europe. Now if you look at the above stats alone with no knowledge of the global macroeconomic issues, you would naturally think that there is a recession or at least a slowdown going on in Asia but that the American economy is doing just fine!

In fact economic statistics show just the opposite, that there is a slowdown and anemic growth in America, but Asia as a whole and in particular China are still growing very strongly, with China in particular growing at about 9%.

This is a great example of what I’m trying to say. First of all you cannot predict macroeconomic issues and factors because there are too many complex variables involved. Secondly, even if you could predict the complex variables, you cannot predict the precise effect it would have on the stock market.

Why with all the gloom about the West have Singaporean and Chinese stocks fallen far more than American stocks this year? Wasn’t America the one that barely managed any growth for the first half of 2011?

When the market goes down, you would naturally get many fund managers/investors telling you they are staying cautious and freed up cash. However, this seems an almost disingenuous statement because it is precisely because many fund managers and investors were bearish and have pulled out of the stock market that the stock market has gone down – this is therefore a statement after the fact.

If more fund managers/investors were more bearish, the market would have fallen even more. What’s going to happen in future with the macro-economy is always 50-50, if it was 65-35 the market would have moved in that direction, priced it in and it would be 50-50 again.

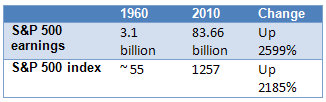

You can’t predict the market as a whole but you can analyze individual companies and their sectors/industries. What I do know is that in the long run earnings are what drive value. Take a look at these stats (table on the right).

It’s intuitive and it makes sense. Value is dependent on Return on Investment (ROI) and ROI is dependent on earnings, current plus future.

Pick the stocks which you believe have good fundamentals, low valuations, good growth potential, and in industries/sectors/countries that you like. At the same time, always keep some cash to stock up more of these companies if valuations go even lower because of global-economic headwinds.

Right now, the profile of companies that are attractive to me from a fundamental and valuation standpoint with significant growth potential is Chinese companies focused on domestic consumption growth, particularly those listed over here and some of the smaller ones in HK which are currently trading at very low valuations.

I will not use up all my cash to buy them all at once, I will always keep more cash just in case the broader market drags them down, but these are the companies I will continue to focus on now based on fundamental valuations. In the long run, they will return to fairer valuations based on earnings. If these returns to fairer valuations are accelerated due to buyouts/privatizations, as will undoubtedly be the case with some of these companies, then all the better.

Recent story: INVESTOR: How my stocks bought with CPF savings have done

Later on once there is less fear in the market and the volatility goes down, the small-to-mid caps tend to become more popular. These beaten down stocks tend to rise even more than the blue chips due to being more volatile stocks.

I will continue accumulating beaten down s-chips for now. This may be the chance of a lifetime so acquire so many profitable companies trading at P/Es of 2 to 3 and many well under NAV.

My stretegy is look for under value companies & their business that will not be affected even during recession or depression.

During late 2008 till 2009 I have been buying up health-care business & cash rich companies. eg First Reit, Thomson medical, Biosensors & Bonvest and able to sleep well.

*First Reit during 2008/2009 is able to paid almost 20% div.

*Bonvest own 2 freehold Ochard Rd Shopping Centre & district 5 star have no debt and cash rich about $80m are been sold down market value less than $200m.

*Thomson Medical during good/bad times able to increased profit increase of 20% to 30%.

During 2008, I am in the red by 20% to 30% after re-stretegies my holding.

I am able to recover my lost & also made 200% profit.

Each time there is a market sell-down look for buying opportunity.

E.g.

1) Giving out consistent dividends

2) Conduct quarterly earning briefing regularly

3) Have good corporate investor relation

4) Provides transparent information and communicates well to shareholders - E.g. score well on the GTI transparency

5) Check the reputation of the auditor

6) Preferably have a Singaporean CFO with a proven track record

For me, I wouldn't buy any company if I can't trust the management. I would think that if the S-chip company hires a Singaporean CFO, i would think that the accounting has a higher credibility compared to a S-chip without a Singaporean CFO.

Right now, fundamental and valuation standpoint

Many people will tell you that when you invest, you should cut losses for the stocks that go down and accumulate more for the stocks that go up. I don't think this is necessarily true.

In the short term, stocks don't always move due to their own company's specific earnings performances,they tend to move with the overall market as well, especially in volatile times.

Therefore when stocks drop in the short term, they don't always drop because of company-specific issues, but because of general market-issues. Being dragged down by general-market issues don't necessarily mean an individual stock that is doing well is not worth owning.

I believe that when you buy a stock for the first time, you cannot be so arrogant/over-confident as to be sure that you'll be buying it at the lowest price. This is very unlikely.

Therefore don't use all your 'bullets' at once, be patient and be prepared to average down and accumulate more if need be, as long as the fundamentals of the companies you invest in have not changed.

But be prepared to hold for the very long-term, because sometimes it simply takes that long for value to be realized. It's hard to say when exactly this happens, sometimes the rise is a very gradual process while sometimes the stock can multiply in a matter of months like you saw with many stocks in 2009, sometimes even faster like you saw with GMG Global early last year, which tripled in a matter of weeks.

This is why I don't sell my holdings just because the general market goes down. You never know when the rapid rise may suddenly happen. I just make sure I have sufficient cash flow to continue accumulating the companies I like.