Excerpts from latest analyst reports....

DMG & Partners expects Trek's earnings to surge in the next 2 years

Analyst: Terence Wong, CFA

Carrying the national flag. In the recent SD Card Association forum held in Turkey, Trek's FluCard® made a stunning impact on the participants.

With a majority of the founding members' vote, the design for the FluCard® is set to become the worldwide standard for all future SD Cards.

Currently, Trek’s management is working closely with other major Japanese camera manufacturers in making its FluCard® the crucial weapon for camera makers to win back the fight against the smartphone makers.

We expect the new specification to be finalised by Oct 2011, and more exciting news to be rolled out in the next few months.

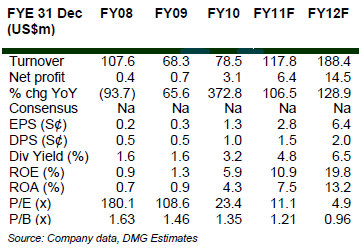

Expecting massive earnings boost. We believe that upon the finalisation of the new SD card standard, most of the world’s major camera makers will become Trek’s customers.

There are two ways that the MNCs can use Trek’s invention, either 1) purchase the license annually if they choose to develop on their own or 2) make Trek an OEM for all.

Either way will enable Trek to unleash its full earnings potential, and we expect its profit to surge in the next two years.

Recent story: TREK 2000: FluCard, Ai-Ball and apps set for takeoff

NRA Capital maintains 'overweight' rating on Anwell

Analyst: Jacky Lee

New orders from India supporting its doubled thin film solar capacity. The group installed the second vacuum chambers for its solar panel production line earlier this month, doubling its capacity to 100MW. This is supported by the US$20m (HK$155m) solar panel orders from India to be delivered in the second half of 2011.

We believe this order should bring the group to its 50% utilisation rate for the current two quarters.

Maintain Overweight. We have reduced our FY11 net loss from HK$35m to HK$23m to factor in higher sales contribution from solar panels. As a result, our fair value has been lifted by 1 ct to S$0.39, still pegged at 0.9x P/NTA.

Anwell has secured Rmb700m capital injection from the Municipal Government of Dongguan for a 19.5% share in its subsidiary, Dongguan Anwell. This values Dongguang Anwell alone at around S$680m or about 7x, larger than Anwell’s current market cap.

Given the undemanding valuation, we maintain our Overweight rating.

Recent story: ANWELL stock up 100% in 5 weeks, OKP's half-year profit up 56%

NRA Capital maintains target price of 20 cents for Serial System

Analyst: Jacky Lee

What we like… Serial continues to gain market share, in USD term, its sales actually grew 18% yoy in 1H11, while the global chip sales in the 2Q were down 2% qoq and 0.5% yoy, according to the Semiconductor Industry Association (SIA).

TDR is still in the works despite the uncertain market sentiment. The Chairman, Mr Derek Goh, continues to purchase shares from open market. An attractive dividend yield. ...

and what we don’t like. Lower-than-expected gross profit margin and high gearing building up (107% gross gearing as at end-Jun11), however, we understand this is natural for a distribution business.

Maintain forecasts and Overweight call. Despite the lower-than-expected 1H11 sales and margin, we have kept our FY11-13 number relative unchanged after we lower our taxation forecast.

Our fair value remains unchanged at S$0.20, still based on 10x FY11 PER. Group offers an attractive yield at 7%. Maintain Overweight.

CIMB maintains BUY call, TP S$0.23 for Serial System

Target price is set at 8.7x CY12 P/E, a 10% discount to Taiwanese leader WPG’s 5 year average forward P/E of 9.65x.

TP drops to S$0.21 if we factor in the 90m TDRs. Interim DPS if 0.3 Scts (1H10:0.28 Scts) payable on 2nd September 2011. Dividend yields of 7.9%-10.5% will support the share price.

• Net gearing has risen to 0.75x from 0.45x at end FY10. Debt has increased to S$119m from S$79.7m at end December 2010. TDR is therefore timely as the proceeds can help to reduce gearing.

• Outlook – challenging environment but Serial System will focus on inorganic and organic opportunities and keep an eye on cost.

Recent story: AUSGROUP, SERIAL SYSTEM: Latest happenings...