TWO OF THE more striking features of Technics Oil & Gas, which recently released a strong set of 2Q results, are its high dividend yield and its rapidly expanding gross profit margin – which should make investors sit up and take notice.

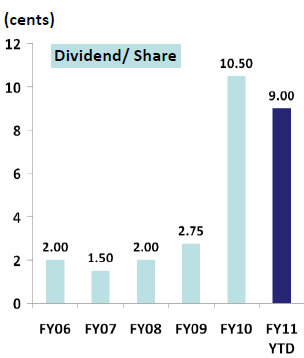

First, the dividends.

Technics has been busy paying out dividends and has one of the highest dividend yields among Singapore-listed companies.

Based on the recent stock price of 99 cents, Technics – which designs and fabricates process modules and equipment that are integrated to form production and storage facilities for oil and gas exploration and production - has a historical dividend yield of 9.4%.

Contrast that with the common situation of shareholders of S-chip companies who have voiced their disappointment over the complete absence of dividends year after year, despite the companies having a big cash hoard.

Technics’ track record of dividend payouts is depicted in the chart on the right.

Evidently, FY10 (ended 30 Sept 2010) was a bumper year as 10.5 cents a share were paid out.

The pace continues in the current financial year. It has just passed its sixth month, and Technics has declared dividends after its 1Q and 2Q results.

The payouts are 6 cents and 3 cents, respectively.

AmFraser Securities, in initiating coverage of Technics on April 28, expects Technics to pay out another 3 cents for the current financial year. For FY2012, the dividend payout is expected to come down to 9 cents, according to AmFraser.

"We like the stock for the high dividend yield, strong operations, and good earnings visibility into FY2012," said AmFraser analyst Lee Yue Jer, adding that the fair value of the stock is $1.20.

For all the cash outflow from the dividend payouts, Technics had cash and cash equivalents of $18.6 million as at the end of March 31, compared to $21.8 million a year earlier.

Technics had a net gearing of 16% compared to being in net cash, respectively.

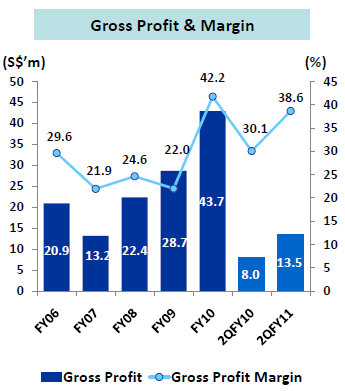

High ~40% gross margin

The other striking feature of Technics is that its gross profit has moved fast ahead of its revenue growth, resulting in higher and higher profit margins.

In 1H2011, revenue grew 10% to $57.3 million but the gross profit surged 37% to $22.4 million, translating into a gross margin of 39%.

In FY2010, the gross margin almost doubled year-on-year to 42%.

Analysts on Tuesday (May 3) asked if the margin is sustainable for Technics’ current order book of about S$130 million, which will be fulfilled through to the first half of FY12.

Robin Ting, the executive chairman of Technics, said: “The margin should be around that level.”

He added: “There’re a lot of projects in the oil and gas industry, and we are able to pick and choose. We are focusing on the bottomline – we don’t want to just grow the topline.”

In addition, Technics has been enjoying cost savings arising from bulk discounts for its projects.

For Technics’ recent powerpoint presentation on its 2Q11 results, click here.

Recent stories:

TECHNICS OIL & GAS: Super performance of TDR and S'pore shares

TECHNICS receives TDR listing approval, announces $23.5 m contract win