Excerpts from latest analyst reports……

Kim Eng Research says market is grossly undervaluing RAFFLES EDUCATION

Analyst: Eric Ong

Our scenario analysis suggests that if Oriental University City (OUC) is successfully listed, then the market would be grossly understating the value of Raffles Education’s (REC) education business. Maintain BUY with a target price of $0.40, which implies 54% upside.

Our View

We reckon there is a good chance REC may float OUC on the Hong Kong Stock Exchange ahead of its targeted timeline of August 2013. Assuming that the initial public offering goes through, OUC could command a P/B of 1.5-1.7x (about S$700-800m), depending on market conditions. At the current price of $0.26, this means investors would be getting REC’s core education business for a steal.

Separately, management is close to identifying a co-developer for the OUC land, which will therefore allow REC to monetise part of its RMB2b investment. A new master planning document has also been submitted to the relevant authorities to convert more land (in addition to the 280,000 sq m) for mixed residential/commercial use. However, based on the company’s experience, the approval process could take up to 1.5 years.

Recent story: RAFFLES EDUCATION, PAN HONG, YANGZIJIANG: What analysts now say....

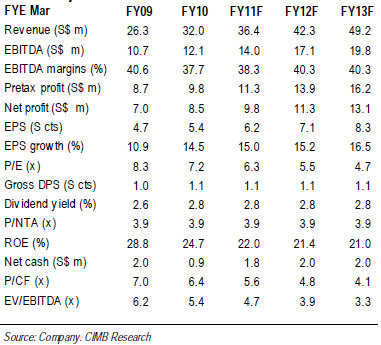

CIMB says HU AN CABLE is ‘good value’

Analyst: Leong Weihao

Good value and excellent growth prospects. Trading at 6.5x historical P/E against 39x of its China-listed peers and 14x of Taiwan-listed (TSE) peers, we see good value in owning this stock.

This becomes apparent when considering its growth potential, a very respectable 3-yr earnings CAGR of 141% over FY11-13, achievable on the back of an aggressive expansion plan to sweep up pent-up demand for power cables, as well as its foray into high value-add ultra high voltage cables.

On a forward basis, the stock trades at 2.9x CY12 P/E, a bargain, in our view.

Recent story: SHIPPING STOCKS, HU AN CABLE: What analysts now say...

CIMB maintains ‘Buy’ call on MENCAST, target price S$0.49

• Maintain Buy rating. We raise target price to S$0.49 (previously S$0.45) based on 10% discount to CY12 industry average P/E of 7.7x.

• Investment merits. We like Mencast for its (i) sound market expansion strategy and (ii) attractive valuations relative to its industrial peers.

• Growth catalysts to drive earnings momentum. We see growth catalysts for Mencast, stemming from (i) capacity expansion to cater to larger scale projects (ii) expansion into new business streams (iii) inorganic growth opportunities.

Recent story: MENCAST: After record 2010 profit, will there be encore in 2011?

Deutsche Bank reiterates ‘buy’ call on GENTING SINGAPORE

The bank’s analyst, Aun-Ling Chia, CFA, noted that with the recent correction, Genting Singapore offers better value at 11x EV/EBITDA.

Deutsche Bank hosted Genting Singapore on an Non-Deal Roadshow in the US last week.

According to Deutsche, investor interest was strong with a focus on market growth, junkets and credit risk.

Genting Singapore’s recent price correction and underperformance vs. Macau peers have led Deutsche to see better value in the stock.

The stock is trading at low-end of historical EV/EBITDA of 11-18x and a 30% discount to Macau peers (15-16x). Parent Genting Bhd recently upped its stake 0.2%.

“With fundamentals intact, a favorable operating landscape and a possible near-term catalyst in seasonally strong 1Q, we reiterate Buy,” said the analyst.

Credit Suisse maintains ‘Outperform’ rating on HYFLUX

Credit Suisse noted that CEO Olivia Lum highlighted Hyflux’s growth strategy to investors recently, focusing on the Asian market.

Hyflux has secured US$76 mn of contracts in China year to date, and management expects strong order momentum to continue.

Credit Suisse says the management expects "low teens" project IRR for its S$890 mn investment in the second desalination plant at Tuas.

“The desalination project will be a breakthrough project for Hyflux as it will include the construction and operation of a power plant,opening up opportunities in the IWPP market.”

Credit Suisse maintains its OUTPERFORM rating and a target price of S$3.00, “as we continue to see strong growth prospects for Hyflux.”