CHASEN'S REVENUES increased by 19% year-on-year in 3Q2011 to S$19.9 million, boosted by its relocation business and related third party logistics (3PL) for sophisticated equipment such as those required by wafer fabrication foundries and LCD panel makers.

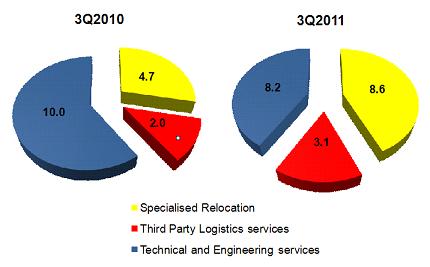

Revenues from the specialized relocation and 3PL business divisions jumped a combined 75% to clock a total of S$11.7 million in 3Q2011.

Revenues from technical & engineering services were up 22% at S$10.0 million. This division includes installation of equipment and fabrication of steel structures for the construction of industrial buildings, usually required to house relocated equipment.

As specialized relocation services enjoy better margins than technical & engineering services, the group’s gross margins improved a good 7 percentage points to 26.6%.

Last year, Chasen was involved in four major relocation projects in China. The management believes China’s policy to plug tax incentives for foreign wafer fab plants established after 2012 will boost its earnings for the next 2 financial years.

”There is a spike in relocation demand to China from wafer fab foundries these two years and this will contribute substantially to our business," said Mr Eric Ng, Chasen’s independent director during an analyst briefing yesterday.

Chasen is a big boy in China for specialist relocation services with skilled manpower of 600 stationed there. It beefed up its manpower strength by some 50% in the past 6 months.

There is competition from large Japanese and Taiwanese logistics players, but these currently have only manpower strength of about 150 in China.

Net profit grew 567% to S$1.2 million, boosted by group tax relief for losses in its engineering business.

Investors were concerned about how the engineering division was progressing. Below is a summary of questions they raised and the management replies.

Q: Why are your accounts receivables as high as S$36 million when FY2010 turnover is only S$76 million?

S$20 million of the receivables is due to poor collection in the construction segment, which has a long payment cycle. This is something we are addressing.

The construction business is separately funded. For example, we need to raise US$400 million for Caitong (164 sq km township project to build infrastructure for a man-made freshwater lake, wastewater treatment system, road works and 4,000 public housing units). These monies raised will not sit on our books.

Instead, we are seeking European private equity for this China government build-and-transfer project-financing scheme. The project will start as soon as monies are raised and will last 3 years. When this project kicks in, revenues will expand but we expect group margins to fall as construction margins are lower.

Q: Is this the first time you’re in this kind of projects?

This is the first time we are involved in this business but our joint venture partner has a track record in China. That is how we managed to be awarded the project. Chasen brings construction expertise and funding to the table.

Q: Are you affected by the rising labor costs in China?

Yes, we are affected but we can pass the bulk of this increase to customers as competitors will be similarly affected.

Q: What is your dividend policy?

We having been paying about 30% and I believe this will continue.

Related story: CHASEN: Logistics Beneficiary Of Semiconductor Boom