Photo courtesy of Isaac.

For the past decade, Isaac Chin has been a full-time investor after a career as a chartered accountant. “I didn't have an inspiring career as an accountant. Nothing great came out of it. If I have to work hard for a salary and put up with a lot of stress, I might as well work for myself - and earn more,” he said.Now aged 62, he has reaped handsome profits from investing in property, equities and bonds. Here he shares his views with NextInsight on the investment landscape and what he is betting on - plus how he spends his money. If you have investing questions to ask Isaac, post them in our forum here.

Photo by Leong Chan Teik

Q: How did your investments perform in 2010? What has been great and what has been bad, if any?

Isaac: My investment tracked the relatively lacklustre STI performance (up 10.9%) in 2010. My investment returns from equity and bonds paled in comparison to my gains in 2009 which was the best year ever for me.

Selling my SGS bonds (totaling $1.5M) in Oct 2010 @ 106.85 cents (bought in 29 June 2010 @ 100.75 cents) was one of my great investment decisions in 2010.

I purchased $500,000 worth of DBS preference shares in October with a dividend yield of 4.7% (10 year SGS Note yield had then dropped to 1.9%). By Dec 2010, I had invested about $5M in A-Reit, CapitaMall Trust, and Suntec REIT.

Q: Care to give a figure for your 2009 investment return?

Isaac: I made about $2 million from equity and bonds in 2009. I was lucky to take a big gamble when the STI plunged to 1457 in Mar 09, 2009.

I remember at that time an investor friend advised me to wait a little longer as he believed STI could hit 1260. My own conviction was that STI had fallen from 3900 in just one year and buying at 1500 level cannot be too far wrong. My defence mechanism was that if STI did fall further to 1,000, say, many people with much higher entry points would get more seriouly hurt than me.

Moreover, I was paying only 2% interest on my mortgage loan against a 12% dividend return from CMT, Suntec, CapitaCommercial Trust and A-REIT at that time. There was a lot of fear in the market, so mathematically and psychologically I could not be wrong.

Q: What led you to make those REIT purchases?

Isaac: The interest rate is very low, as you know. Bank deposits are paid interest at less than 0.5%p.a. Currently the SGS 10 year bond pays about 2.7% p.a.

The yield spread between S-Reits and SGS Bond will remain attractive at least for the next 6 months.

I have chosen to invest in those 3 Reits because of their large market capitalisation and asset class quality. Moreover, I can receive a constant stream of dividend Income of about 6% per annum.

Q: What have you been busy with in the stock market in January?

Isaac: Not just in January but since Mar 2009, at the bottom of the global crisis, I have spent lots of time figuring out the performance of the stock market. My view is that there should be a mini bull run from here with, say, a 15% upside.

Thereafter, I may switch some funds back to SGS Bonds (whose yield could have risen to 3.5% by then).

The STI was roaring ahead in the 1st week of 2011. It closed at 3279 on Jan 6 but finally dropped to 3179 on Jan 31. I am convinced that it will break out of this tight range and move up to 3500 level in the next 6 months based on fundamentals and technicals.

Q: Currently, aside from REITs, what are your other significant investments, if any?

Isaac: I have 2 freehold condos valued about $4.5M, and insurance policies with cover of over $1M. I pay $36,000 a year in premium for the policy with NTUC Income that provides my family cover against 30 diseases.

Q: Do u use leverage for investing in stocks and property?

Isaac: Less than 50% leverage for the 2 properties and none for the stocks.

Q: What is the net yield on your investment property?

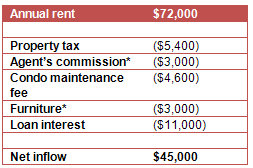

Isaac: The rental income after expenses is $45,000, so the net yield is $45,000 divided by $650,000 (capital employed or the cash I paid) = 6.92%

The property purchase price was $1.75M (inclusive of $50k stamp duty) while the loan was $1.1M for which I now pay 1% interest a year.

Current valuation of the property is about $2.15M.

Q: Aside from investing success, what can you say about success in other areas of your life?

Isaac: I have never aspired to be a wealthy person and do not consider myself wealthy at this moment. I think success in life is more than just having money management skills. It should include enjoying a healthy lifestyle, having positive attitudes, a proper mindset and correct relationship with family and friends. All these help to create a balanced personality. Basically I am happy, healthy, optimistic and confident.

Q: I understand that you place good health as a top priority. What do you do to achieve good health?

Isaac: I do not smoke but drink a glass of red wine each day. Every morning I would exercise 20 mins on the treadmill, swim 20 mins, take yogurt, wheat germ, raw oats and milk for breakfast, and salmon, snow fish and pumpkin for dinner.

Only occasionally do I eat fried kway tiao and hawker food with friends. I think my life is quite regimented with 6-8 hours of daily work, 5 days per week.

I read, watch comedies and documentaries on Discovery and National Geographic channels, listen to music and have regular lunches with old friends and school mates for relaxation, and holidays to Europe, Japan and China every 4 months to de-stress. I retire to bed early, before 10 pm and wake up by 5 am.

Q: You do enjoy travelling. Why so?

Isaac: Travelling is a form of education. I have visited the Versailles in Paris, the Vatican City in Rome. I have been to Venice, and to Mt.Titlus in Switzerland where I was awe-struck by what I have saw. I thought: the beautiful scenery and architecture must be the Creation of a Superior Being!

I normally cover only 2-3 countries in each trip lasting 15-20 days. Free and easy travel is what I best enjoy. Once in Japan we spent a long time watching the rainbow and sunset by a lake, without the time limit usually set by tour agents, and it was a wonderful experience.

At age 62 now, I can still remember the Chinatown in which I was born and grew up in the 50's and 60's. We lived in cubicles, with 35 people (mostly migrants from China) squeezed into a tiny flat of about 700 sq ft. Such memories of hardship have made me easily contented today.

If you have investing questions to ask Isaac, post them in our forum here.