SHARES OF XinRen Aluminium Holdings Ltd (SP: XAH) yesterday closed at 43 cents, still 22% below its IPO price of 55 cents in late October - but the company 's fundamentals appear solid as it reported yesterday that its January-September net profit had skyrocketed over 452% to 256.7 mln yuan.

And given the China-based firm’s very stable and enviable alumina supply deal along with expectations of firmer aluminum prices next year, Xinren Chairman Zeng Chaoyi says he is “very optimistic” on the current quarter and 2011.

“We fully expect aluminum selling prices to increase in 2011 with strong consumption growth in China anticipated next year, especially for the construction sector,” said Mr. Zeng during the company’s third quarter results briefing.

But it was not just the rapid growth in demand that was fueling optimism at XinRen Aluminum.

“We are one of the lowest cost smelted plate and finished aluminum product producers in China, and coupled with the fact that for next year we expect higher value-added products to contribute 50-60% to revenue from around 40% now means that I am very optimistic on the current quarter and next year,” he told analysts at Raffles City Convention Centre.

“We expect an even stronger fourth quarter.”

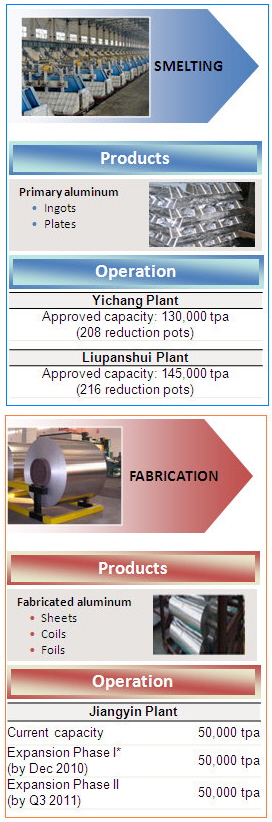

Xinren’s smelting segment continues to be the key sales driver of the business, contributing 58.4% of revenue in the third quarter ending September 30.

The segment benefited from higher selling prices and a pickup in exports of its aluminum plates to post a year-on-year sales increase of 4.4% to 931.4 mln yuan for the quarter.

Xinren, China’s most cost effective large-scale vertically integrated aluminum producer, would have had an even more standout third quarter if not for the 15.4 mln yuan expenses associated with the recent listing on the Singapore Main Board.

As an integrated producer, Xinren has made fruitful efforts to bolster its downstream fabrication business, which resulted in third quarter sales jumping 25.3% to 151.8 mln yuan.

Alumina supply locked in at good prices

Mr. Zeng went to great lengths to impress upon the fully-occupied conference room of participants the importance of the main raw material used in the production of finished aluminum – namely, alumina.

“Alumina is the lifeblood of our industry,” he said.

And the fact that the company had recently locked up a strategic long-term supply deal for the commodity with two major players in the alumina trading business was another reason to be very optimistic about Xinren’s fortunes going forward.

“Management’s foresight to secure long-term contracts for alumina at attractive terms also gives us a significant costing edge over competitors who need to purchase alumina at increasingly higher spot prices. This unique arrangement allows Xinren to capture the upside growth potential of the aluminum industry while capping the downside risk of increasing raw material prices,” Mr. Zeng said.

Xinren recently inked a landmark five-year deal locking in alumina supply from both Chalco and Minmetals, two giants in the industry, with prices for the raw material fixed at around 17.1% of the price of finished aluminum as stated on the Shanghai Futures Exchange (SHFE).

“This is much better than our competitors who pay between 16-28% of SHFE prices, so we are decidedly on the low end of this spectrum,” he said.

NextInsight asked Mr. Zeng if having Chalco, China’s largest producer of finished aluminum and a potential competitor of Xinren in the downstream sectors, would present a possible conflict down the road.

“Absolutely not,” he said.

“Chalco, Minmetals and now Xinren are all listed companies and act according to stringent codes of conduct. So despite the fact that Chalco and Xinren vie for the many of the same customers in the finished electrolytic (finished) aluminum product sector, Chalco’s alumina supply contract to us is immutable and stable.”

He also said that Xinren was a very formidable competitor in the finished aluminum market and was well positioned to compete head-to-head with its domestic Chinese peers, regardless of market caps.

XinRen to benefit from rising aluminium prices

XinRen is very bullish on aluminum demand and prices going forward thanks to a very low per-capital consumption of the metal by Chinese compared to other major economies as well as an ongoing campaign to phase out outdated, inefficient or heavily polluting aluminum smelters in the country.

Some 600,000 tons of outdated smelting capacity of slated for elimination

“We are poised to benefit from increasing aluminum prices. With current prices at 16,011 yuan per ton, which exceeds the third quarter average of 14,903 yuan, we expect fourth quarter profits to be better sequentially,” Mr. Zeng said.

He said that industry researchers have forecast China’s aluminum consumption to grow at a compound annual rate of 17.6% over the next three years.

Already the largest aluminum consumer in the world, China’s demand is expected to be driven by strong consumption and direct government support to maintain economic growth.

And Mr. Zeng said that if the world’s largest economy initiated yet another “stimulus plan” of its own, then aluminum prices would see even more spectacular growth, and so would XinRen.

“If Washington launches another QE (Quantitative Easing), the third in two years, then I fully expect aluminum prices to rise even further and faster,” he said.

And with rising aluminum prices, stable alumina supply costs and a fast growing market, another of the company's major expenses was likely to decrease.

"We still have room to lower our electricity prices even further," he said.

"China is a very high-growth aluminum market and we are a very competitive player in the market."