Excerpts from latest analyst reports…

DnB Nor reiterates ‘buy’ call on ASL Marine

Analysts: Kay Lim & Thor Andre Lunder

Bonus shares issue expected to be concluded by end of this year. No real impact on valuations, NAV remains the same before issue but lower on per share basis (post bonus issue) due to additional shares from the bonus issue.

As a result of the enlarged shares from the bonus issue, target price adjusted down from SGD/sh 1.35 (pre-bonus issue) to SGD/sh 1 (post bonus), inline with lower NAV per share.

And forward estimates are also adjusted down, to account for the enlarged shares outstanding, FY2011E EPS -29%.

We remain positive on ASL's business fundamentals for its favourable position in the growing Indonesia coal transportation market. BUY reiterated.

Recent story: ASL MARINE: Best-equipped yard for ship repair in Indonesia, more jobs expected

NRA Capital has a ‘buy’ call on Swing Media as green energy biz takes off

Analyst: Jacky Lee

Green energy is progressing well. Last year, Swing Media announced to buy an 80% stake in Shanghai Hui Yang New Energy, a turnkey installer and after sales servicer of solar powered energy. This acquisition is conditional on Hui Yang securing Rmb12.5m worth of contracts by Sep-2010.

In late September, its standard of solar-powered energy system was officially recognized by PetroChina. The company was also awarded the most growth enterprise in new energy industry for 2010.

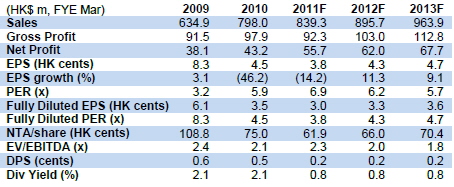

Maintain forecast and Buy recommendation. We have fine-tuned our FY10-12 net profit by 2% to 4%. Nevertheless, we lower our fair value from S$0.09 to S$0.07 after shares dilution (ex-right issue), pegged at 0.6x FY03/12 now (from 0.6x FY03/11). Given the green energy business is likely to take off and help diversify revenue steam, we maintain our Buy call.

Recent story: TAT HONG, SWING MEDIA: What analysts now say....

Kim Eng Research downgrades Asiatravel.com to ‘hold’

Analyst: YEAK Chee Keong

Asiatravel.com’s (AST) FY Sep10 results came in below expectations with lower net profit of $1.6m (‐70.7% YoY) despite higher revenue of $82.0m (+15.6% YoY). The disappointing performance was due to higher operating expenses arising from aggressive launches of new products and sales channels.

Consequently, no final dividend was declared and full‐year total dividend was 0.6 cts per share. We downgrade the stock to HOLD as we see further challenges for the group in the near term.

We see potential for AST to scale up its business but we expect FY Sep11 earnings to remain suppressed as the company intends to continue its marketing activities into 1HFY Sep11. Recovery in earnings will likely be visible only from 2HFY Sep11, which could be a catalyst for us to re‐rate the stock.

Recent story: SUPER, ASIATRAVEL.COM, SHIPPING STOCKS: What analysts now say.....