Photo by Pearl Lam

AT YESTERDAY’S TDR conference at Marina Bay Sands, market players agreed that while a growing number of TDR issuers mean more competition for funds, TDRs remain a sure way of improving a stock's market valuation.

True enough, a check on the best performing TDR issue from Singapore shows that for United Envirotech, while its parent shares have taken a beating along with the broad market correction (by 12.9% since 9 Nov), its TDRs are still trading at firm prices.

At the last closing price of 40.5 cents, its shares are down 15.6% since 22 Oct when its TDRs started trading.

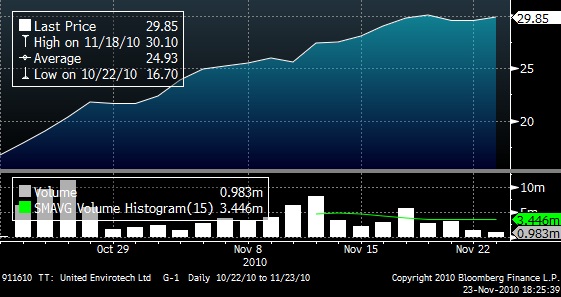

In contrast, its TDRs (911610.TW) have shot up by a whopping 90.7% to NT$29.85 apiece compared to an offer price of NT$15.65.

The impact of a TDR listing is made more clear with the current weak market sentiment: United Envirotech’s parent shares in Singapore are still trading about 10% higher compared to its range-bound stock price of around 37.5 cents before the listing approval came from Taiwan.

Fundamentals ultimately make the difference when it comes to valuation, said United Envirotech’s CEO, Dr Lin Yucheng at the conference.

Dr Lin highlighted the company's strong fundamentals: Sinopec, CNPC and CNOOC are customers.

The 3 state-owned oil majors dominate China's petroleum industry.

Because of its strong customers, it has healthy receivables.

It has a strong team. It has strong technology. For instance, it built Asia's largest wastewater treatment facility, and is one of the top 5 membrane water and wastewater treatment solutions provider in the world.

And it certainly helps that tech stocks, water treatment and China concept plays are themes well received by Taiwan investors.

One reason for sustainable rich valuations on Taiwan’s bourse is the hot money that is getting into the country, said Oceanus executive chairman Dr Ng Cher Yew who also spoke at the event.

”Chinese money is looking for Taiwanese investments,” said Dr Ng.

Oceanus listed in Aug a second tranche of TDRs backed by 150 million existing shares to give minority shareholders a chance to gain from the valuation premium on its TDR platform.

Oceanus is China’s largest abalone farmer and wants to tap on its huge market for processed gourmet seafood.

Dr Ng believes being on Taiwan’s bourse works well for Oceanus as this gives it mileage in Taiwanese media, which reaches China.

Photo by Pearl Lam

For small to medium-sized companies looking to raise money in Taiwan, Gretai is the best TDR platform because an unwritten rule at the Taiwan stock exchange is that the later accepts companies with net earnings of US$10 million or more, said Polaris Securities’ chief advisor CY Huang.

Polaris Securities is the underwriter for more than half of this year’s TDR issues, and the main sponsor for the event.

And investor relations will have a greater role to play as competition heats up for the Taiwan dollar with the growing interest by foreign issuers in the premium valuations accorded on the Taiwan bourse, said Mr Huang.

Co-sponsors at the event include Financial PR, Singapore’s largest investor relations agency, audit firm Deloitte, Lee and Li attorneys and depositary bank Chinatrust.