Excerpts from latest analyst reports….

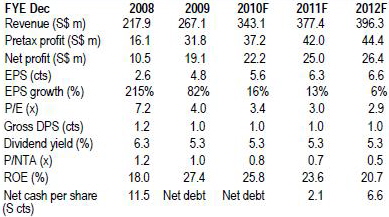

CIMB says Action Asia’s target price is still 40 cents, with 100% upside potential

Action Asia (www.actionind.com.my) continues to achieve new record sales and profitability in the September quarter despite signs of slowing consumer demand, reflecting its solid product offerings.

We leave our FY10-12 profit forecasts unchanged for now. Action remains attractive, at 3x CY11 P/E and below its book value. Our target price remains S$0.40, offering more than 100% upside. This already conservatively pegs Action at slightly below 6x CY11 P/E.

What we like

• It continues to deliver a solid set of 3Q10 results despite signs of slowing consumer demand in the US and Europe. The company achieved record volume in the September quarter, shipping about 2.2m units of portable DVD players, standalone DVD players and digital photo frames.

• 11th consecutive quarter of double-digit yoy profit growth. Bottom line would have been stronger if not for a S$1.1m forex loss and S$0.6m allowance for doubtful debts.

• Surprise interim dividend of 0.5cts in 3Q10.

• Deteriorating balance sheet with net gearing inching up from 0.19x as at end-June to 0.35x as at end-Sep. This is due largely to longer cash cycle days as a result of backend loaded sales in the September quarter, resulting longer A/R days. We believe A/R days will improve in 4Q10 as sales should peak in 3Q10.

Outlook – Sales and profit expected to drop qoq

• Our discussions with the management suggest that volume should peak in 3Q10, and order should slow qoq in 4Q10. This is not surprising as most customers would have placed their order in early Sep to mid-Nov to prepare for the year-end Christmas sales season. This is also in-line with our assumptions.

• Raw material availability has improved and prices have softened, which is generally positive for ODMs like Action.

• Moving forward, the group is working on blu-ray related products for Philips. It is also in discussions with Philips’ other divisions to extend its services. Additionally, Action is also hoping to widen its customer base, tapping on its existing strength in ODM capabilities.

• Key concerns for the group include: (1) continuous weakening of US$ as bulk of its sales are quoted in US$; (2) more aggressive bidding by some domestic consumer electronics makers and may affect Action in terms of pricing; and (3) limited growth potential moving forward if the group continues to depend heavily on Philips’ portable DVD players.

Recent story: ROKKO, ACTION ASIA, BIOSENSORS: What analysts now say....

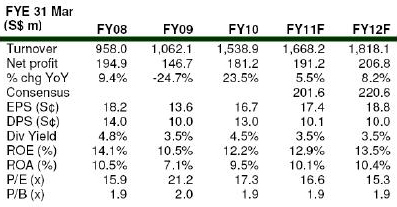

DMG says SATS, after strong 2Q, is a buy with S$3.25 target price

Analysts: Melissa Yeap & Terence Wong, CFA

Excluding the effect of jobs credit of S$6.3m in 2QFY10, PATMI would have risen by 30.6% YoY. 1HFY11 PATMI amounts to S$89.5m while 1HFY10 revenue amounts to S$783.3m, making up 46.8% and 47.0% of our full year forecasts.

An interim dividend of 5 S¢ was declared and is payable on 2 Dec.

Management remains optimistic on its outlook with particular emphasis on the coming 3Q which is seasonally its strongest. Key challenge going forward would be the rising prices of food. Our DCFderived fair value of S$3.25 implies an FY11F P/E of 18.7x. Based on last closing, there is a 12.5% upside. Maintain BUY.

Contributions from its overseas associates rose 51% YoY to S$15.9m boosted by higher volumes in overseas ground handling joint ventures.

Outlook. Management was positive on its coming 3Q which has traditionally been its strongest quarter, due to the holiday and festive season. Revenue from its UK operations are also expected to be stronger in the second half due to seasonality.

A key concern that was raised during the analyst briefing was the rising cost of food prices which is expected to remain a challenge going forward.

Recent story: SATS, FRASERS CENTRERPOINT TRUST: What analysts say now…