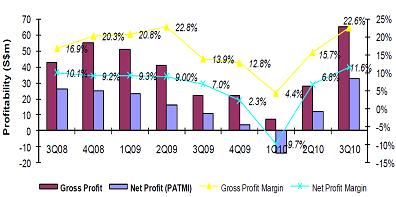

Hi-P’S 3Q10 net profit of S$33 million (+208% y-o-y, +168% qoq) was a record high, exceeding DBS Vickers forecast despite as much as S$10 million in one-off items.

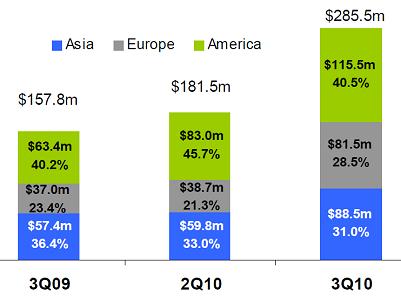

3Q2010 revenues up 57.3% quarter-on-quarter at S$285.5 million, driven by stronger ramp up of new projects for Apple and RIM as well as higher demand from Seagate and P&G.

It is currently on more than 4 new projects, which contribute more than 40% to top line.

The new projects are for components ranging from smartphones, tablets, portable devices to consumer electronics.

”Strong execution is important as this wins customer confidence,” said its CEO Yao Hsiao Tung during an analyst briefing held yesterday at the Fullerton Hotel.

The management believes customers are likely to come back to Hi-P for next generation products as it has extensive experience in the smartphone business, which is a growing consumer segment.

DBS Vickers analyst Tan Ai Teng upped her target price to S$1.30 (from S$1.26) yesterday, reiterating her ‘Buy’ call on the leading consumer electronics component manufacturer.

The analyst was impressed by Hi-P’s gross margin expansion of 6.9 percentage points to 22.6%, thanks to improved operating leverage, product mix and effective cost controls.

However, Ms Tan believes higher labor costs and pricing pressure would cap further margin expansion.

One-off items include a S$5.4 million forex loss as well as impairment of S$4.4 million on property, plant and equipment.

28.5% of group revenues come from America, and during the quarter, the USD depreciated as much as 6% against the SGD, explained CFO Samuel Yuen.

Net cash declined by 28% to S$173.5 million, while gross gearing remained low at 0.8%.

The management believes that 4Q10 revenues will be comparable to the third quarter, partly contributed by new projects.

Below is a summary of questions raised by investors at the briefing and replies by the CEO, the CFO and the COO, Mr Gary Ho.

Q: Please tell us more about new projects and how sustainable they will be.

We started ramping up on new products during the third quarter. Product life cycle is typically one to two years. Ramp profile varies between segments.

Q: Who are the new clients?

They are mainly from US and Europe.

Q: Are you facing cost pressures in China?

The pressure of RMB appreciation against the USD and the Euro will continue. We will try to automate more, improve efficiency and improve utilization rate.

Productivity and cost management is a continuous effort we must undertake. One example of this is reducing wastage by shifting production from locations with idle capacity to a consolidated site.

Q: Are you done with plant rationalization?

This is ongoing. We will continue to look at product mix and location. Today, we have centralized management and catered for different products being manufactured out of one location. We still have room for improvement.

Q: Will the impairments in 3Q continue into 4Q?

Yes, this is due to ongoing restructuring.

Q: Are the forex and impairments realized?

Forex losses and impairments include provisions as well as realized portions.

Q: How much of cost increase in 3Q was due to staff salary increase?

Total direct labor strength including contract workers increased in line with product demand.

Q: Can you sustain gross margins?

I believe we can maintain it at 15% to 20%, but this is dependent on product mix, cost control and utilization.

Q: Are the new projects for products that have been launched?

Yes

Q: Are you the first or second source of component supply to the client?

This depends on the project. We may be a second supplier, but end up with a greater market share than the first supplier. This is because we can improve productivity and troubleshoot more quickly.

Q: What are you supplying for tablets?

Mechanical components.

Q: The tablet market is expected to move up explosively over the next quarter. How does that affect your internal forecasts for 4Q?

This market segment is only part of our diversified businesses. Impact will not be significant. 4Q is Christmas season, but we may have started manufacturing and accruing revenue in 3Q.

Q: What are your plans for your huge cash hoard?

We have plans but this cannot be disclosed yet. Customers also require a strong balance sheet when appointing suppliers.

Q: Are you facing component shortages?

Yes, the electronics components market is very tight for 3Q and 4Q. We understand this will ease at the beginning of next year.

Q: What is the average price you paid for treasury shares? Do you intend to continue buying?

To-date, we have spent about S$34 million on close to 52 million shares. Our average price is 65.4 cents. Our mandate is to buy up to 10%, and we have only bought back slightly less than 6% currently.

Our latest purchase was S$1.05 in early Oct.

Related story: HI-P jumps 13%, plays on privatization offers