This new business will provide monthly cash infusion.

Yesterday, Sinotel announced it had signed a contract to provide these services to China Telecom worth RMB25.3 million a year. Such services cover China Telecom’s base stations in 8 provinces and cities such as Beijing, Hebei and Guangdong.

Sinotel will, among other things, monitor and report faults, downtime, call-drop frequencies and signal strengths of China Telecom’s network in those 8 geographic areas.

Revenue for the contract will start to flow into Sinotel from 4Q of this year, said Mr Jason Li, Sinotel’s CEO a at a lunch briefing for analysts.

Instead of the RMB2.1 million monthly average, the monthly revenue in 4Q is expected to be about half that figure as the company would still be in the midst of installing the hardware and software for these services in some areas.

Sinotel’s capex for this is RMB80 million.

There is scope for more similar contract wins for Sinotel in other provinces and cities.

The initial contract win covers 35,000 base stations, but China Telecom has some 600,000 base stations all over the country, said Sinotel executive director Pan Liang.

And the competition? According to CEO Li, there are only a handful of companies, including Sinotel, capable of providing such services.

An indication of that is that there were only four which tendered to build the hardware for these services for another telco. The tender was subsequently awarded to Sinotel.

Another new development at Sinotel is it is on the verge of entering another business area: the provision of telecommunication infrastructure, including the installation of fibre optic network in buildings.

It will ride on a government policy, announced in May this year, that the private sector is encouraged to participate in building telecommunication infrastructure, a field that until now has been the responsibility of state-owned telcos.

Watch this space for Sinotel’s announcements on any concrete moves in this business.

In the meantime, Sinotel is busy with its core business of designing and installing wireless network solutions in an industry that the government has forecasted in 2Q would see further investments of RMB240 billion by next year to expand the coverage of the 3G network in China.

The sum of RMB250 billion is massive compared to the RMB160 billion spent up to March 2020 by the telcos.

The network expansion continues to attract new 3G subscribers: As at end-June this year, China had 25.2 million subscribers, up 40% compared to the same period a year ago.

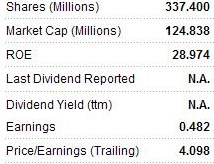

Promising as it is, this core business of Sinotel sees long receivable days – a fact that seems to deter the market from giving Sinotel a higher valuation, which currently is about 4X PE.