|

MTQ Corporation’s business has demonstrated its resilience in the 2008/2009 financial crisis, with its net profit up by 10% for the year ended 31 Mar 2010 (see table).

Earnings per share rose faster at 13% owing to a reduced issued share capital after MTQ bought back its shares at 40-50 cent a share during the economic downturn.

Aside from buying back its shares cheaply, MTQ also invested in equities then.

As at end-FY10, it was sitting on a net gain of $5.16 million in the fair value of its shares investment (which helped boost its total comprehensive income to $19.1 m)

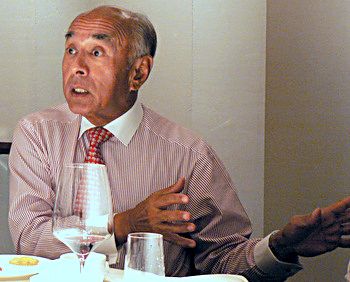

MTQ’s chairman, Kuah Kok Kim, met with analysts over lunch (at Marina Bay Sands!) last Friday and some key takeaways from his briefing are:

* Overall, MTQ’s two key businesses (engine systems in Australia and oilfield engineering in Singapore) are expected to continue to grow in the current financial year;

* MTQ’s newly-acquired distributorship for Bosch after-market automotive products in Australia is gaining momentum (no figures given on FY10 performance).

* The construction of MTQ’s US$20-million greenfield project in Bahrain is on track - the first phase will open by early 2011.

However, in the 4-5 months prior to that, MTQ will incur expenses hiring workers and training them – without any revenue from the Bahrain business to offset that. So, some dampener on the 2H results can be expected although MTQ is looking into ways to mitigate that.

This project looks set to be a major revenue contributor. At 10 acres, the site is about 3X the size of MTQ’s facility in Singapore, and MTQ looks set to be the biggest player there.

”Our facility will be far bigger than any of the current operators, and we will have brand new equipment and we will be far better equipped,” said Mr Kuah.

More importantly, as Mr Kuah noted, it is located in the oil-rich Middle East region where the cost of production is only US$2-3 a barrel. So, oil production is not affected by any wild fluctuation in the price of oil.

“Many people have asked how we will deal with the competition – quite frankly, that is the least of our concerns. I am confident about getting the business.”

He added: “Our major concern is how well we train our staff, and get them to do the work according to our standards. That’s the make-or-break factor for the venture.”

Asked how much of the US$20-m investment has been paid out, he said it’s US$2-3 million.

While its business continues to generate a healthy cashflow and the company has S$20 million in net cash, MTQ is likely to turn to bank borrowings to help fund its Bahrain venture.

This, in part, is to enable MTQ to take advantage of low interest rates and to have cash to capture other business opportunities, said Mr Kuah.

MTQ's powerpoint presentation on its FY10 results can be found here.

Recent story: MTQ gets new CEO, who is a current CEO at PSA & chairman's son