NOTE: Tat Hong released a 'profit guidance' announcement on SGX this evening (Jan 16)

TAT HONG is Credit Suisse’s top pick in the construction sector, according to the broker’s report dated Jan 14.

”We believe that infrastructure projects across Asia will continue to drive growth for Tat Hong, with management looking at allocating more cranes to Australia, to support a strong pipeline of oil and gas projects, and to raise tower crane capacities in China, via bolt-on acquisitions,” wrote analyst Chua Su Tye.

“Historically, during downturns, aversion to equipment ownership drives rental demand over ownership, which should help buoy crane hire-out rates.

Tat Hong (market cap: about $348 million) trades at 0.9x Price/Book, on a stronger balance sheet, and a 10% dividend yield, according to Credit Suisse.

The stock's historical PE is 3.5X based on a recent price of 70 cents.

Credit Suisse: ”We maintain our OUTPERFORM rating and target price of S$0.95.”

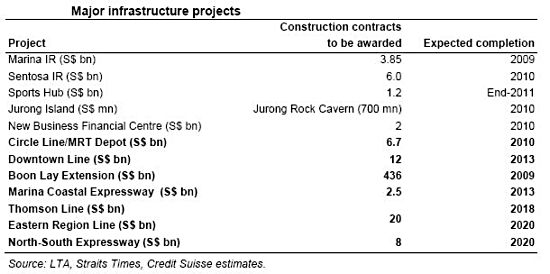

The analyst noted slowing private sector contract momentum in Singapore as the property market fundamentals weakened. However, public sector contracts are likely to partly offset falling private sector orders going forward. The government is bringing forward the S$4.7 bn in public sector projects that have recently been postponed to ease construction costs.

This adds to the almost S$16 bn in infrastructure contracts to be awarded for the Marina Coastal Expressway and Downtown Line construction.

”We expect these to filter down to the players in the supply chain. While we see falling construction costs in the coming quarters as positive for industry players, tight credit markets could heighten overall earnings risks.

”Despite undemanding valuations for the construction companies, a less sanguine outlook, coupledwith low liquidity, continue to justify our sector MARKET WEIGHT.”

Credit Suisse expects the announcements of the many contracts that will be awarded for the high profile public sector infrastructure projects to continue to boost sentiment for the sector.

According to the Building & Construction Authority (BCA), construction demand in 2008 is estimated to have reached a record high of S$34.6bn.

In a Jan 15 report, CIMB-GK analyst Lawrence Lye said overall construction demand is expected to moderate this year to S$22bn-28bn.

The BCA has released 3-year construction demand forecasts for the first time to help the industry with its resource planning. Construction demand for 2010 and 2011 has been projected at S$20bn-27bn.

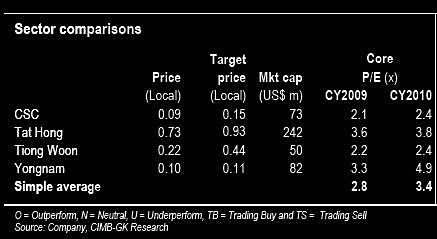

CIMB-GK has the following valuation and recommendation for construction stocks:

CSC: maintain Outperform and S$0.15 target price.

CSC remains relatively insulated from the global economic crisis as construction activities in Singapore should stay relatively healthy in 2009. It also has the advantage of being at the front end of the construction value chain, which means it typically gets paid for jobs done early in the project cycle when project accounts are still full.

We are keeping our forecasts unchanged. We maintain our 0.8x CY09 P/BV valuation. Current valuations are at unprecedented lows despite a strong balance sheet, strong order book and sound fundamentals.

TAT should remain a beneficiary of ongoing construction activity in the region, although construction could grow at a slower rate in 2009. TAT’s competitive advantage is its flexibility to relocate cranes to where the demand is in the region. We base our target price on 0.8x CY09 P/BV, in line with its trough valuation. Our target price implies 4.6x CY09 P/E.

Tiong Woon: maintain Outperform and S$0.44 target price.

In its September quarter results, we cut our FY10-11 earnings estimates by 5-29% to reflect more moderate expectations given a more challenging environment, particularly for its fledgling Bintan yard. With a looming recession, we peg a P/BV trough valuation of 0.8x, translating to S$0.44. The stock is trading far below its current book value of S$0.428 and offers good value.

Yongnam: maintain Outperform and S$0.11 target price.

We made minor adjustments to our FY08-10 net profit forecasts following its September-quarter results to reflect stronger revenue, steady gross margins but higher SGA expenses. We base Yongnam’s target price on 0.8x CY09 P/BV, in line with peers’ target, which translates to S$0.11.