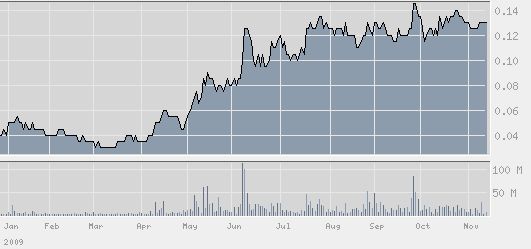

China New Town stock has gone up 4X from its March low.

AT 13 cents a share, China New Town Development (CNTD), which is listed on the Singapore Exchange, has a market cap of about S$408 million.

This is less than half of the Net Asset Value (S$1.2 billion, or RMB5.9 billion) of the crown jewel of China New Town (www.china-newtown.com), a leading developer of large-scale new towns in suburban areas of China.

We did a back-of-the-envelope calculation of its Luodian project in Shanghai, which has an inventory of 1.063 million sq m of residential land available for sale.

The NAV estimate turns out to be more conservative than that done by a NextInsight reader in our forum recently (click here).

SHARP TURNAROUND IN Q3

|

|||||||||||||||||||||

* Wuxi Project (anticipated completion in 2013);

* Shenyang Project (anticipated completion in 2015);

* Changchun Project (acquired in 2007).

The total cost of investment for these three projects is about RMB1.2 billion. Carried at cost, these projects plus Luodian would give China New Town a NAV of about S$1.4 billion potentially.

China New Town, in its joint ventures with municipal governments, will fund the resettlement of residents and enterprises of the land it acquires.

It then builds infrastructure and utilities and prepares land parcels for public auctions.A 102,246 sq m land parcel from the Shanghai Luodian Project was sold in September this year for RMB1.4 billion, or RMB9,070 per sq m.

The sale contributed significantly to the increase in revenue of China New Town in Q3 this year (see table above).

The proceeds from the land sale had not been received by end-Sept, resulting in the trade receivables on the Q3 balance sheet rising sharply by 278% to RMB1,097 million.

Disneyland news sent land prices up ….

Ben Cheng, CEO, China New Town, at a briefing for analysts.

Ben Cheng, CEO, China New Town, at a briefing for analysts.Photo by Sim KihLand prices in China have headed north but particularly sizzling has been Shanghai which announced on Nov 4 that it has given the green light for the construction of a Disneyland theme park.

Just an hour and a half after the announcement, a piece of land in the vicinity of the park was auctioned off for RMB21,062 per sq m, or a total of RMB1.19 billion.

That bodes well for China New Town as the Disney park is located about 30 minutes’ drive away from its Luodian project.

China New Town is expecting new listings of land parcels for auction from its Luodian project in the current quarter.

Since November 2003 and up to the end of Q3 this year, China New Town has recorded revenue of RMB5.3 billion from the sale of 1,307,836 sq m of land from its Luodian Project.

For our story on the company's recent financing challenges and its business model, read: CHINA NEW TOWN: What doesn't kill you makes you stronger