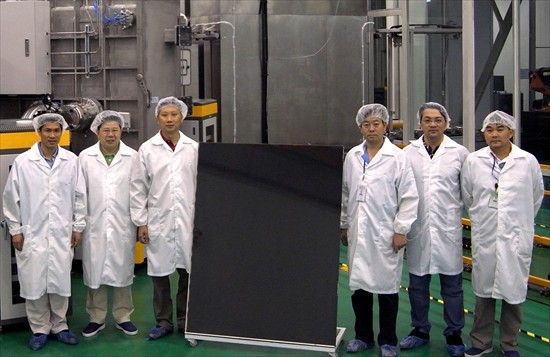

ANWELL TECHNOLOGIES has produced its first thin-film solar panel from its plant in Henan, China, marking a milestone on a journey that began about two years ago.

Mass production of the 1.1 x 1.4 metre panels is expected to start in Q4 this year or Q1 next year.

About 1,500 panels can be produced daily, or roughly a panel a minute.

Anwell, which is listed on the Singapore Exchange, started building its massive production line from scratch two years ago, using its own proprietary technologies and tapping on its expertise in another core business.

The size of the production line (80 metres by 100 metres) in its 40-MW plant hints strongly of the complicated process for producing panels.

“Today, including Anwell, there are only four companies in the world that can build on such a scale fully automatic production lines to produce thin-film panels. We are the only one in China,” said Franky Fan, chairman and CEO of Anwell in a teleconference yesterday (Sept 1) from his China office.

Anwell is vertically-integrated: it not only develops the production line but also uses it to manufacture the panels.

“The advantage is we save on capex cost for the equipment, unlike other solar panel makers who buy equipment from Japan or US,” said Franky.

Taking into account the capex and manufacturing costs, the general figure in the market for producing solar panels is about US$1 per watt – but Anwell’s cost will be as low as just half that figure, said Franky.

Anwell has developed PECVD equipment – which is vital for the production – that the company says is the world’s first ‘multi-substrate multi-chamber’ system. In short, it has higher productivity and lower manufacturing cost.

In China, there are only three or four competitors to Anwell.

Anwell is targeting to sell its panels to Europe, the US and, in due course, China, which is likely to grow to become the world's biggest market for solar panels.

Anwell has received expressions of interest from potential customers but it has to obtain certification to sell to the key markets.

On market trends, Franky said demand for solar panels has picked up from Q2 as the credit market has eased and financing is flowing to solar farms, restarting stalled projects.

The Obama administration and many governments around the world, including China, are stimulating demand for solar energy, among other green projects.

“This government push has led many industry people to say that by end of next year, there will be a serious shortage of supply of panels.”

On the supply side, the credit crunch has led to a slowdown in the capacity expansion for panel production worldwide. As a result, “supply and demand is expected to come to an imbalance by late next year,” said Franky.

Have panel prices gone up with demand in Q2 and Q3? There is some slight increase, but longer term the price trend is down as solar panels become commoditised, said Franky.

Anwell’s vertically-integrated business model for its solar panel business is the same as for its optical replication business: Anwell sells production lines for manufacturing DVDs, for example, and also manufactures its own DVDs for the world market.

Recent stories:

ANWELL shareholders keen to know about its new solar venture

ANWELL: Getting ready to launch solar panel production