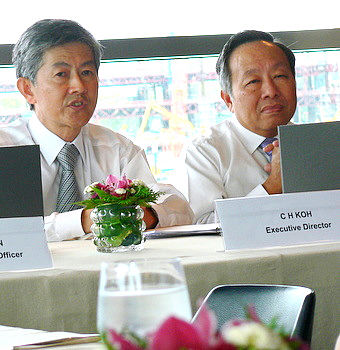

"THE SUPPLY OF alligator skins will drop sharply one year from now,” said Heng Long’s executive director, Mr Koh Choon Heong, at a recent investor lunch last Thu.

Heng Long has secured enough alligator skins to meet demand until as late as May 2011.

What this means is Heng Long will be the one scarce source of supply in the upcoming sellers’ market when competitors find themselves short on inventory.

The events leading to this do not come entirely by chance.

SGX-listed Heng Long, a tannery of luxury crocodilian leather, has clout over supplies due to its huge take-up from the farms.

Last year, in line with its sourcing strategy, it bought an estimated 25%-30% of the world’s supply of farm alligator skins.

The management was in the southern US state of Louisiana this May to discuss with the authorities and farmers about halting the harvest of alligator eggs to better manage future short term global supply.

As it takes about 12 months of breeding before a hatched alligator is ready to be culled, Mr Koh expects supply of skins in Jun 2010 to May 2011 to bottleneck drastically.

When this happens, Heng Long will reap the benefits of its stockist strategy.

Heng Long’s alligator skins are mostly made into watchstraps for luxury timepieces retailing in excess of S$5,000 apiece.

Sale of alligator skins traditionally contributes 30% to Heng Long’s top line.

However, global export volume of Swiss watches had fallen 26% since Jan to 11.8 million pieces in Jun, hitting its 1H09 results.

1H09 sales had fallen 56.8% year-on-year to S$15.6 million, while net profits fell 74% to S$1.6 million.

This was mainly due to a contraction in sales volume rather than price erosion, said Mr Koh.

Gross margins had also slid by 7.1 percentage points to 26.5%.

In the aftermath of a plunge in Swiss watch exports, tightening the leather supply is one strategic response by luxury watchstrap makers, said Mr Koh.

As a price leader, Heng Long also purchased half of the world’s supply of Nile crocodiles last year as well as 10% of the South American Caiman crocodilian species.

Nile crocodile skin is processed into luxury handbags and apparel while Caiman, a slightly lower grade of exotic skin, is used for boots in the USA and Mexico.

While the outlook on demand for luxury watchstraps remains uncertain, Mr Koh expects the demand for crocodilian leather from European luxury brands and Asian manufacturers to remain relatively resilient.

He also expects annual global production of African Nile crocodile skins to drop by more than 10% to 140,000 to 160,000 in 1 to 2 years.

| Species | Source | Est. world supply | Est. % of world supply purchased by Heng Long |

| Farm Alligators | USA | 300,000 – 450,000 | 30 |

| Nile Crocodile | Africa | 160,000 – 180,000 | 50 |

| Caiman | South America | 500,000 – 700,000 | 10 |

| Other crocodilian species | Other countries | 80,000 | 12 |

Table from Heng Long: Breakdown of crocodilian skins purchased by species (%) as at FY08.

Related stories:

| 16 Apr 2009 | HENG LONG: 'More enquiries on croc skin |

| 25 Feb 2009 | HENG LONG: Targeting China |