WHO ARE THE laggards in this sharp, surprising market rally?

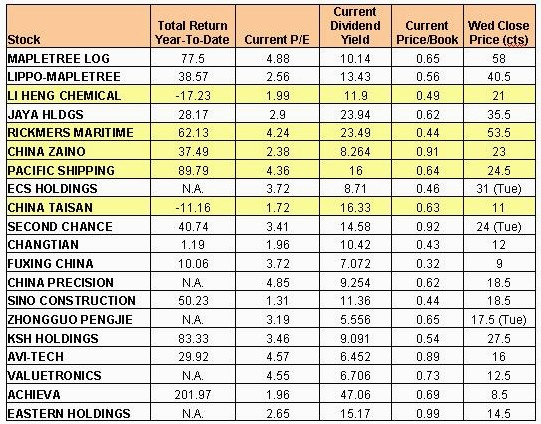

We did a search on Bloomberg of stock that meet all the following screens:

* PE less than or equal to 5.

* Price/Book less than or equal to 5

* Dividend yield equals to or more than 5

The results are the stocks that appear on this page. Certainly there might be undiscovered gems among them but we don’t think all are necessarily worthy of investment.

To start with, the dividend yield of some of them look high but it’s not sustainable. Similarly, their PE ratios make them look cheap but that’s before any adjustment for a plunge in their earnings this year given the lousy economic climate.

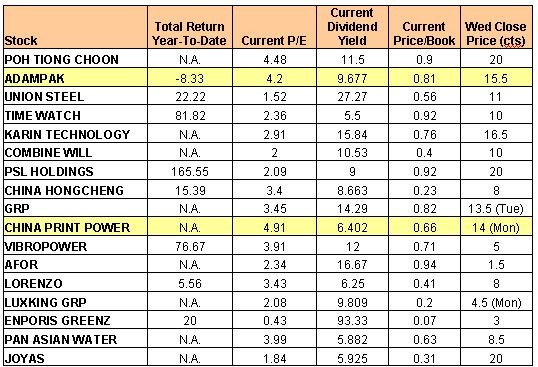

Most of these stocks are not covered by analysts, so there is not much to go on. The few which are and/or whose business stories we know of are as follows (highlighted in yellow in the two tables), along with snippets of what has been reported recently:

Li Heng: The stock has plunged in the past year but UOB Kay Hian is seeing signs of recovery.

“China’s nylon fibre industry has seen a substantial improvement since the beginning of the second quarter. We expect Li Heng and China Sky to record quarter-on-quarter earnings improvement for 2Q09,” said UOB Kay Hian analyst Allen Jiao recently.

He is maintaining a “buy” on Li Heng with a target price of S$0.29 (closing price: 23 cents yesterday), based on Hong Kong peers’ average FY10 PE of 5x.

Read our China correspondent's recent exclusive interview with the chairman of Li Heng > LI HENG: Aiming to emerge leaner, meaner, greener

Rickmers Maritime: OCBC Investment Research analyst Meenal Kumar has a ‘sell’ rating on Rickmers Maritime and a fair value price of 39 cents. The shipping trust is expected to report its Q2 results in early August.

China Zaino: The stock is trading at 2.3x 2009 PE, which is less than half of its Singapore-listed peer’s average, not to mention the great discount as compared to Hong Kong-listed sportswear retailers’ average of 18.3x, according to UOB Kay Hian.

UOB Kay Hian values the stock at a 25% discount to its S-shares average and arrived at its target price of S$0.35, implying 4x 2009 PE. It maintains its 'BUY' call.

China Taisan: See our last report in October 08 > CHINA TAISAN: Enjoying growing orders from sportswear makers

Adampak: Between June 16 and June 25, Chua Cheng Song, the CEO, accumulated 1.182 million shares on the open market at between 16 cents and 16.5 cents a share. Adampak closed at 19 cents yesterday.

Mr Chua's direct holding now stands at 7.799 million shares, or 2.957% of the issued share capital.

For its Q1, Adampak reported a 62% plunge in net profit to just US$624,000. In its results announcement made in May, it sounded more optimistic about the near future, saying:

“After a quarter of low consumer demand and inventory rationalization, business sentiments have since improved. We are cautiously optimistic of our performance for 2Q2009. However the ongoing uncertainty in the global economic situation continues to pose challenges for businesses.”

There are some insightful comments made recently about Adampak at Wallstraits forum, especially from a credible shareholder 'dydx'. To read, click here.

Recently, we had an article on DBS Vickers calling for a ‘buy’ on several tech stocks, given the broad recovery in the tech sector > VENTURE, HI-P, CSM, MEIBAN, BROADWAY: What DBS Vickers now says....

China Print Power: Read our recent exclusive interview in Hong Kong > CHINA PRINT POWER grossly undervalued, says French shareholder