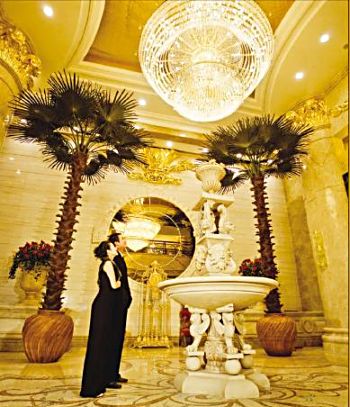

Lobby of Yanlord International Apartments. Photo: annual report

Macquarie Research reiterates positive stance on Yanlord

Earnings and target price revision: No change – we previously adjusted our target price and earnings to reflect the new share placement.

12-month price target: S$3.10 based on a PER methodology.

Catalyst: Strong sales in Shanghai and launch of new projects during 3Q09.Action and recommendation: We will revisit our full-year cash sales target when Yanlord launches new projects and reports its 2Q09 results – likely to be mid-August.

The CBRC’s increased focus on enforcing existing second mortgage rules may slow Yanlord’s sales going forward given high investor demand for its projects.

To date, we believe the impact of the changed stance has been limited. We maintain Yanlord as one of our preferred China developers and have an Net Asset Value of S$2.9/sh with a target price of S$3.1/share based on a Price-Earnings Ratio methodology.

Macquarie Research upgrades K-REIT’s target price to 84 cts

K-REIT Asia reported 2Q09 distribution income of S$17.5m (Distribution Per Unit of S¢2.64), which is S$4m ahead of expectations. We upgrade KREIT’s target price to S$0.84 (from S$0.66) on the higher distribution but maintain our Underperform rating given the 18.5% downside to our revised target price.

We raise our FY09–11 DPU forecasts by 10–18% due mainly to higher-than expected interest income from the shareholder loan to ORQPL (unlisted) and a higher proportion of management fees paid in units. We upgrade our target price to S$0.84 from S$0.66.

Within the office sector, we prefer CapitaCommercial Trust (CCT SP, S$0.87, OP, TP: S$1.08, 24% upside) given the higher upside.