Annual reports are reaching the mailboxes of shareholders, and being uploaded by companies to the SGX website. The annual reports sometimes contain interesting information about shareholders. Readers have highlighted Best World and JEL Corp (and there are a few more to come).

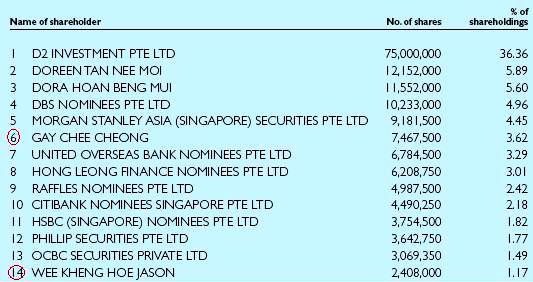

From the 2008 Best World annual report

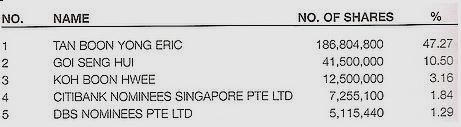

From the 2008 Best World annual report

BEST WORLD for Gay Chee Cheong

In the 2008 annual report of Best World, a well-known investor, Gay Chee Cheong, has emerged as a shareholder.

As at 12 March 2009, he held 7,467,500 shares or 3.62%. His name did not appear in the 2007 annual report, which suggests that he bought into Best World as the stock fell in the course of the past year.

Some background on Gay: He and Tommie Goh were the founders of JIT Holdings, the electronics contract manufacturer, which Flextronics bought in a US$640 million cash-share swap in 2000.

Gay and Tommie then formed an investment company called 2G Capital to invest their millions of dollars in promising companies such as Hyflux, Midas Holdings, Raffles Education, and Asia Environment Holdings.

Another noteworthy shareholder is Jason Wee Kheng Hoe, who increased his stake from 921,000 shares (in the 2007 annual report) to 2,408,000 shares.

Jason was the ex-regional head of research at CLSA. In 2005, he and his team were ranked No.1 in Small Cap Research by Institutional Investor.

Jason has been consistently ranked in the top three in his field, culminating in the top place for the regional smaller companies research for all three continents (Asia, Europe, US) in the prestigious Greenwich poll in 2005.

Recent story: BEST WORLD: Insights from FY08 analyst briefing

Investments in JEL stock turn sour for top investors

In the 2007 annual report of JEL Corporation, the well-known investors were Sam Goi Seng Hui (‘Popiah King”) and Koh Boon Hwee (chairman of DBS Group).

In the 2008 report (image above), they are still listed as shareholders with shareholdings which are unchanged from those in the previous report.

Their investments have turned sour. JEL stock has bombed out, needless to say, and recently traded at 2 cents.

Much of the blame can be laid squarely on the ex-chairman and founder, Eric Tan Boon Yong, who resigned in October 2007 after the Commercial Affairs Department began investigating the company. Eric is still the biggest shareholder of the company.

In January 2008, after a four-month independent review, auditors KPMG Forensic said it found irregularities in the financial affairs and operations of JEL.

KPMG's report said certain information and documents had been destroyed, altered, removed or irretrievably erased from JEL's premises and computer systems.

It cited the deletion of electronic data from the computer server systems.

Accounting records and other documents were either destroyed or removed from the offices. Accounting records of the group maintained in its accounting system were also voided or modified.

KPMG said JEL's profit for the first half of 2006 should have been about S$1.9 million and not S$8 million as reported by the company.

As for the first half of 2007, it should have recorded a loss of S$1.4 million instead of the profit of S$4.3 million it reported.