DBS Vickers' report of May 13 - that's three months old - is the most recent one we know of on CSE Global although in the past other brokers have covered the stock.

DBS Vickers in its May 13 report said it expected CSE Global, which is listed on the Singapore Exchange, to deliver 30% earnings compounded annual growth rate (CAGR) for the next two years.

“Valuation is undemanding at 9.7x FY08F PE compared to small and mid cap peers’ 10.3x given its healthy growth prospects.

"CSE remains a buy with target price of S$1.63 pegged to 15x FY08F PE, or 11.6x FY09F PE.”

Subsequent to the report, CSE reported a 40% jump in Q1 net profit to $12 million, and then a 34% jump in its Q2 profit to $14 million for a total of $26 million in the first half of this year.

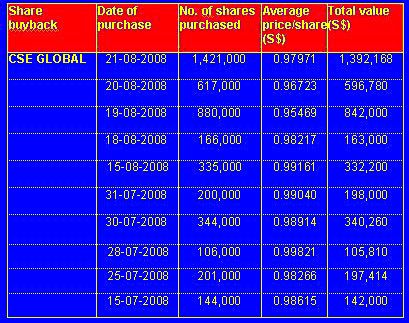

Its outstanding order book as at end of 2Q 2008 was $319.3 million. Following the release of its 1H results, it started its share buyback programme on July 3 with a modest purchase of 59,000 shares executed between $1.00 and $1.03 a share, and then stepped up its purchases aggressively.

The stock has since held up relatively well even as the wider market – especially China shares – tumbled.

It is now trading at around 98 cents cum interim dividend of 1 cent. Book closure is Sept 2.

For those not familiar with CSE, it is one of the largest independent system integrators in the world.

Read more at its website here.