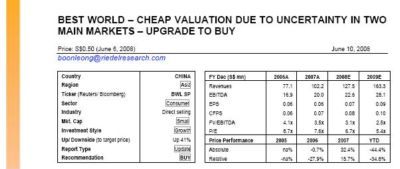

RIEDEL RESEARCH has derived a new fair value for Best World of 83 cents, down from $1.03. But it upgraded the stock from a ‘hold’ to a ‘buy’ because of its cheap valuation and because of the ‘high potential upside” of China’s market.

Riedel did so after cutting its net profit forecast by 14% and 16% for 2008 and 2009, respectively.

Riedel now forecasts S$15.4 million and S$19.0 million net profit, which translate into 14% and 23% earnings growth, in 2008 and 2009, respectively.

Riedel's revisions were prompted by its concern over possible decreased consumer spending in Indonesia and Malaysia as a result of escalating oil prices. These two countries accounted for 70% of Best World's revenue last year.

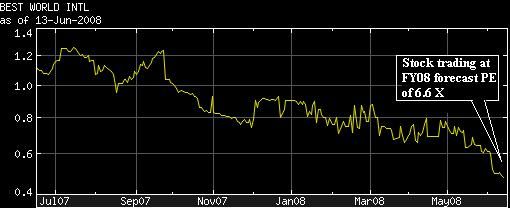

In a June 10 report, Riedel said it applied a 15% discount to its 83-cent fair value because Best World’s stock is illiquid to arrive at a target price of 70 cents. The stock recently traded at 48 cents.

”Upside is 41%. We upgrade recommendation from HOLD to BUY because of the high potential upside and the price catalyst from its future activity in China,” wrote Rieldel analyst Chew Boon Leong.

”China is BWL’s ace card for future growth.”

BWL announced last December its plan to acquire a 51% interest in Nanjing Joymain Sci and Tech Development Co Ltd, which essentially owns a direct selling license for the Jiangsu province with 16 product licenses, and a manufacturing facility, according to BWL management.

BWL will merge its own 16 health food licenses with Joymain’s, emerging with 32 licenses.

BWL expects to obtain approval from the Ministry of Commerce for the change in ownership of the direct selling license and the transfer of product licenses by earliest August 2008, instead of July 2008.

Riedel’s Boon Leong noted that BWL traded at an average historical PE (historical price/historical same year earnings) of 11.8x over the past three years when EPS CAGR was 30%.

”It now trades at PE of 6.7x and 5.4x based on our reduced 2008 and 2009 earnings. The share is trading at a 50% discount to its global peers in the direct selling industry. This discount partially reflects its small market capitalization.”

Daiwa’s 88-cent target

Four days before Riedel’s report, Daiwa Institute of Research senior investment analyst Chris Sanda issued a report on Best World, saying: “At this price, it is an attractive value stock and growth stock, in our view.

”Best World has good upside potential through its recent expansion into the PRC market, which has obvious market potential, in our view.” His target price: 88 cents.

Recent story: BEST WORLD: Why the sharp fall?