TO MANY investors, MTQ Corporation may need some introduction because it is relatively unknown.

But to its shareholders, the stock in recent years has proven to be one of the top 10 dividend yield stocks among the nearly-800 stocks on the Singapore Exchange.

For example, for the financial years ended March 2007 and 2006, the gross yield was 6.41%

and 7.69%, respectively.

These were based on year-end stock prices of 39 cents and 32.5 cents, respectively, and a gross dividend payout of 2.5 cents in each of those two years.

Today (Apr 30), MTQ proposed a tax-exempt (one-tier) final dividend payout of 2 cents a share, up from 1.5 cents a share, less tax, last year.

Taking into account its interim payout of 1 cent, less tax, the total dividend is a record for the company. The yield at a recent share price of 60 cents would be 5%.

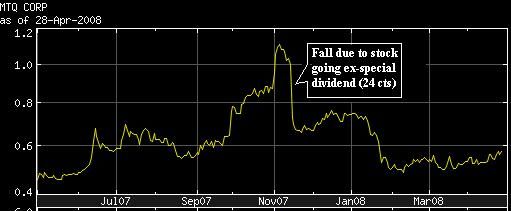

Not included in the 5% yield is a whopper of a special dividend payout of 24 cents a share, less tax, last November. This was made possible by MTQ’s net gain of $28.2 million (as announced during its interim results statement) from the sale of its stake in Aussie engineering company RCR Tomlinson.

Given the attractive yield, it is not surprising that the stock is tightly held, which makes the stock rather illiquid.

At a lunch briefing for analysts and media today, Mr K.K. Kuah, chairman and CEO of MTQ, said that, barring unforeseen circumstances, he is confident of maintaining a dividend payout of 3 cents a share in the current financial year, which began on April 1.

“We continue to forecast profit growth for our business, though it will not be in the same quantum as last year,” he said.

Reflecting the cheery outlook, MTQ has been buying back its shares regularly, though in small quantities each time. In fact, MTQ can afford to buy back buckets of its shares, as it is sitting on a net cash balance of about $29 million, equivalent to $0.31 per share, as at March 31 this year.

Evidently, it deems its shares to be undervalued. Per share net asset value as at 31 Mar

this year was $0.613.

MTQ's FY ’08 ended March 31 was the best in the 38-year history of the company. Highlights:

* Group revenue grew 24.7% to S$84.7 million;

* Pre-tax earnings jumped seven-fold to S$51.23 million helped by an exceptional gain of S$40.79 million arising from the divestment of its stake in RCR Tomlinson. Ignoring the effect of the divestment, the group achieved pre-tax profit of S$10.44 million, up by 64.2%.

* Net profit jumped 704% to S$37.85 million.

MTQ is a beneficiary of the booming oil exploration business, which is now driven by high oil prices.

MTQ repairs sophisticated offshore oil-drilling equipment at its workshop in Pandan Loop. Its customers operate in neighbouring countries such as Indonesia, Malaysia, Brunei, Thailand and Vietnam.

MTQ Engineering is the authorised repair workshop for OEMs such as Cameron, Varco-Shaffer and QVM.

What if the price of oil falls in future? Mr Kuah is not overly concerned as there will be many more oil rigs in the region which require maintenance work from MTQ.

Another strong fundamental of MTQ’s business is that as a result of sharp planning, the company has upgraded about 90% of its machinery in the last four years, which raised its effective efficiency.

The capex amounted to S$15-16 million over that period. Going forward, the capex is fairly limited, said Mr Kuah. This suggests that there will be substantial savings that will flow to the bottomline.

Asked about MTQ’s order book, Mr Kuah said the company’s business can be likened to that of a car repair workshop which constantly gets business but does not have an order book.

Each MTQ job typically lasts no longer than six weeks, and is priced at between US$200,000 and US$500,000, he said.

The company is looking for growth opportunities, including replicating its operations in other regions, he said.

MTQ already has a presence in Australia, where its engine systems division is in the business of distributing turbochargers and fuel injection parts accounts for the remaining portion.

”We should expect it to deliver an improved performance as the full effect of cost savings and other synergistic benefits begin to materialize in the coming financial year,” said Mr Kuah.

Recent NextInsight story: MTQ: Little-noticed beneficiary of oil & gas industry boom