AUSGROUP is not experiencing any shock waves arising from the US subprime mortgage problem.

In fact, the industries that AusGroup (www.ausclad.com.au) does business in, such as oil & gas and mining in Western Australia, are as robust as they were last year, if not more so.

So said Mr Stuart Kenny to more than 20 analysts at a meeting in Singapore yesterday (Wednesday Jan 23).

“AusGroup is on track for growth,” said Mr Kenny, 55, the long-time managing director of AusGroup who stepped down to become an executive director on Jan 7 this year.

Despite the strong business outlook, AusGroup's stock price has been swept along by the gloomy stock market sentiment, and has fallen 45% from $1.95 in early November ’07 to $1.08 this week.

At the meeting, Mr Kenny introduced his successor, Mr John Sheridan, who has 19 years of experience in oil and gas project management, operational management and general management in Australia, Asia and Europe.

Mr Sheridan, 42, has a civil engineering degree and a MBA, and is vice-president of the Indonesia-Australia Business Council.

Reassuring analysts on the business fundamentals of AusGroup, Mr Kenny cited statistics on the robustness of the various industries that the company operates in, such as:

* A total of A$91 billion of investment has been announced for the Australian oil and gas industry.

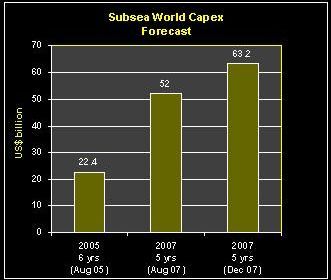

* As at August 2007, the size of the global subsea market for the next five years was estimated to be US$52 billion, according to Quest Offshore Resources. Just four months later, the estimate was upped to US$63.2 billion.

* As of end Dec ’07, AusGroup had an order book of A$192 million. It currently has tenders for A$362 million worth of work.

Mr Kenny also cited the example of Rio Tinto which, within the space of several months last year, raised its planned output of iron ore from over 300 tonnes a year to over 400 tonnes in five to seven years. Iron ore is used to produce steel.

Rio, which is expanding aggressively to meet demand from China in particular, will have lots of work for contractors such as AusGroup.

Net margins (7% last year) will further improve with contributions from Singapore-based Cactus Engineering (~15%), which became a 100% subsidiary last year.

On AusGroup’s exposure to the weakening US$, Mr Kenny said in Australia, the company’s business is carried out in Aussie dollars.

In Singapore, subsidiary Cactus transacts in Singapore dollars. In all, AusGroup has very limited exposure to US$.

On the global credit squeeze, Mr Kenny said AusGroup is not affected as it has cash and approved credit lines.

New business

While AusGroup continues to expand its

business services to the core industries it

serves, it is developing new businesses too.

Naval shipbuilding involves the same skills base that AusGroup applies to industries such as oil & gas, said Mr Kenny.

Another potential new business is renewable energy. Cactus has the machining and manufacturing expertise for components that operate on the ocean floor that can be applied to the tidal power business, said Mr Kenny.

With its expanded capacity via its purchase last year of a 30,000 sq m piece of land in Tuas, Cactus can take on far more work, including work in non-traditional areas.

Recent NextInsight story: AUSGROUP: Strong growth to continue