THE IPO of economy hotel developer and operator Global Premium Hotels has been attracting much interest from analysts and fund managers, thanks to Singapore’s vibrant tourism scene.

Singapore tops Asia Pacific in travel and tourism competitiveness, ahead of Hong Kong, Australia and New Zealand, according to The World Economic Forum.

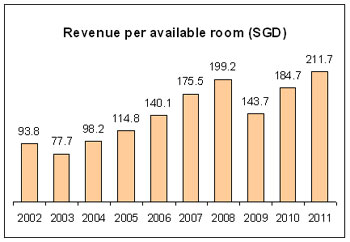

And this has translated into growth in revenue per available room (RevPar) generated by Singapore gazetted hotels of a good 9.5% (CAGR) a year over the past decade.

Singapore’s year-on-year RevPar growth in good years can reach the high-twenties.

Singapore hotels were resilient to last year’s uncertain global economic outlook, thanks to the high volume of visitors from China, India, Malaysia and Indonesia, which had GDP growth rates blistering ahead at 5.2% to 8.1% in 2011.

Singapore’s RevPar last year grew 14.6% year-on-year to S$211.70 per room per night.

Global Premium is raising net proceeds of S$112 million from the IPO. S$74.8 million (64%) will be used to pay down the purchase of its hotel assets from its parent company, SGX-listed real estate developer Fragrance Group.

Another S$30 million (26%) is intended for the development of its hotel business in Singapore and overseas.

It has 22 economy hotels under the Fragrance brand name and one mid-tier hotel under the Parc Sovereign brand name in Singapore.

”Net margins generated by budget hotels are usually higher than for higher-tier hotels,” said CEO Eddie Lim.

Global Premium has managed to maintain net margins at around 40% for Parc Sovereign, in line with its Fragrance hotels.

The other advantage of being a budget hotel chain operator is that occupancy actually increases during times of economic uncertainty as visitors look for affordable alternatives.

It generated net profit of S$19.9 million in FY2010, up 47% year-on-year. The company has a dividend policy to pay at least 80% of net profit after tax in FY2012.

Photo by Sim Kih

Below is a summary of questions raised during an investor briefing yesterday (Friday) and the replies of Mr Lim and CFO Chen Loong Mey:

Q: Why did you not structure your company as a REIT since your assets yield stable income?

We want to develop our own assets. There are limitations to developing real estate under the REIT structure.

Q: Does the scandal involving the under-aged prostitute affect your business?

All hoteliers are subject to the same risk in this area. Even the high-end hotels are exposed to such incidents. We do not see such scandals as a threat to our business.

Demand and expansion plans

Q: Where is the demand coming from for budget hotels?

A lot of Malaysians stay at our Geylang hotel, which offers the most affordable rates. Also, when the economy is good, demand overflows to budget hotels. During peak seasons, our Balestier hotel can command as high as S$200 per room per night. During the SARS crisis, many high-end hotels lost money but we were still profitable.

Q: Where will you focus on expanding? Fragrance or Parc Sovereign?

It really depends on the property site that we are able to get for development. A small plot will go to the Fragrance brand, which is a budget hotel. For the mid-tier market brand Parc Sovereign, we need a plot that is big enough to include things like a sizable swimming pool.

Q: Is there a possibility of converting a Fragrance hotel into a Parc Sovereign brand hotel?

It is possible, but plot sites for Fragrance hotels are smaller. So, the number of rooms will come down after conversion.

Segment margins and costs

Q: How do margins differ between customer segments? Do walk-in customers yield the highest margins?

Yes, walk-in customers yield the highest margins. Travel agents give us the lowest margins, but they also give us high take-up of idling rooms well in advance.

Q: Can you increase your room rates?

We are in a very price-sensitive price segment. So, we have to be very careful about this.

Q: Who sets the room rates in your competitive space?

Hotel room rates are very transparent. We want to provide affordability and we do not want to overprice ourselves compared to the competitor. Pricing has a lot to do with hotel location.

Q: How does the rise in labor costs affect you?

There will be fewer and fewer Singaporeans in our sector. Singaporeans don't realize that a chambermaid's job is much tougher than a cleaner's. We have a system of retaining existing staff. We have no choice but to engage more foreign workers as they are the ones that help to stabilize our operating cost. The good thing is we haven't seen a sharp increase in staff cost.

Comments