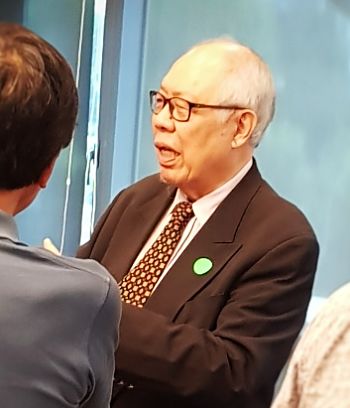

Hotel Grand Central gets no attention these days (and for many years already) from analysts or fund managers despite it being a relatively large stock (market cap: S$937 million).  Tan Eng Teong, chairman and MD, Hotel Grand Central, is one of two founding directors of the company which was born 50 years ago. Tan Eng Teong, chairman and MD, Hotel Grand Central, is one of two founding directors of the company which was born 50 years ago. NextInsight file photo.It doesn't help that the listco's investor outreach has been minimal and hotel stocks in general have been out of favour. But a low profile is probably fine with the controlling shareholders of Hotel Grand Central: They have been busily picking up its shares throughout this year. Maybe it's one of their ways to celebrate the 50th anniversary of the company, a vintage that few companies listed on the Singapore Exchange have achieved. A special 3-cent dividend along with a 5-cent ordinary dividend per share were paid this year by Hotel Grand Central, which listed in 1978, a good 40 years ago. |

|

Stock price |

$1.29 |

|

52-week |

$1.29 – $1.59 |

|

PE (ttm) |

29 |

|

Market cap |

S$937 m |

|

Shares outstanding |

727 m |

|

Dividend |

3.9% |

|

1-year return |

-3% |

|

Source: Bloomberg |

|

Starting from just one hotel on Orchard Road, Hotel Grand Central currently owns 14 hotels in five countries.

It also has six investment properties in Australia and New Zealand.

The controlling shareholders have been at the helm for a long time.

Tan Eng Teong is the Chairman and MD, having been with the Group since the inception of the company. So has his brother, Tan Teck Lin, an Executive Director of the Company.

What would be your total return if you have held the stock for the long haul?

Let's look at total returns over 5 years, 10 years and 15 years (using the dividend data on SGX website and price chart of Yahoo!).

|

|

5-year holding period: bought at end 2013 |

10-year holding period: bought at end 2008 |

15-year holding period: bought at end 2003 |

|

Share price (on purchase) |

$1.08 |

53 c |

38 c |

|

Capital invested (10,000 shares) |

$10,800 |

$5,300 |

$3,800 |

|

i) Share value today (@$1.29) |

$12,900 |

$12,900 |

$13,545 (incl bonus shares) |

|

ii) Dividends collected |

$3,400 |

$5,550 |

$8,068 |

|

Total (i + ii) |

$16,300 |

$18,450 |

$21,613 |

|

% gain |

51% |

248% |

469% |

|

Average gain p.a. |

10.2% |

24.8% |

31.3% |

From the table, it can be seen that:

• Dividends accounted for a significant portion of the total return.

• A 15-year investment yielded the best result: an excellent 31.3% per annum gain on average.

Which goes to show that some steady businesses can yield satisfactory outcomes if held for a long period. Too many retail investors instead seek high-risk businesses with short-term catalysts which may not materialise.

(See subsequent story: HOTEL GRAND CENTRAL: If you had opted for scrip dividends, what's your gain?)

See also: