PAX Wins Major Indian Order

PAX Global Technology Ltd (HK: 327), a leading electronic funds transfer point of sale (EFT-POS) terminal solutions provider in China, has won a major Indian order.

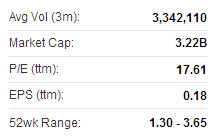

The Hong Kong-listed firm's wholly-owned unit, PAX Computer Technology (Shenzhen), was granted a large tender via solutions provider Trimax in India to supply 10,000 mobile devices to enable electronic fare ticketing in Bangalore. PAX Global's recent Hong Kong share performance. Source: Yahoo Finance

PAX Global's recent Hong Kong share performance. Source: Yahoo Finance

The Bangalore Metropolitan Transport Corporation (BMTC) is the sole public bus transport provider for the urban area, India's third most populous city, carrying close to five million passengers daily.

PAX’s mobile S90 terminal was selected as a proven device offering GPRS communications, Visa payWave and Mastercard PayPass contactless services, as well as possessing the latest PCI 3.x and EMV certifications. PAX is China's top EFT-POS firm. Photo: PAX“PAX approaches the Indian market with a more flexible strategy, one which embraces collaboration with local solutions providers so that they can develop software themselves on the PAX platform,” said Mr. Daniel Poon, President at PAX for the Asia Pacific region.

PAX is China's top EFT-POS firm. Photo: PAX“PAX approaches the Indian market with a more flexible strategy, one which embraces collaboration with local solutions providers so that they can develop software themselves on the PAX platform,” said Mr. Daniel Poon, President at PAX for the Asia Pacific region.

Mr. Jack Lu, Chief Executive Officer at PAX, added: “We are grateful to BMTC to be given the opportunity to provide the top-selling S90 POS terminal model as part of the integrated Trimax solution.” PAX recently 3.10 hkdPAX Global Technology Ltd (HK: 327) is an electronic funds transfer point-of-sale (EFT-POS) terminal solutions provider. PAX is principally engaged in the development and sale of EFT-POS terminal products and the provision of solution services. PAX was listed on the main board of The Stock Exchange of Hong Kong Limited in December 2010. The Group currently collaborates with over 35 partners worldwide on EFT-POS solutions. According to The Nilson Report Sep 2012 Issue, the world’s leading source of news and research on consumer payment systems, PAX Global ranked #4 globally by shipment volume of EFT-POS terminals. PAX’s EFT-POS products are sold to more than 70 countries and regions including the US, Singapore, Taiwan, Japan, South Korea, New Zealand, EMEA and Central Asia.

PAX recently 3.10 hkdPAX Global Technology Ltd (HK: 327) is an electronic funds transfer point-of-sale (EFT-POS) terminal solutions provider. PAX is principally engaged in the development and sale of EFT-POS terminal products and the provision of solution services. PAX was listed on the main board of The Stock Exchange of Hong Kong Limited in December 2010. The Group currently collaborates with over 35 partners worldwide on EFT-POS solutions. According to The Nilson Report Sep 2012 Issue, the world’s leading source of news and research on consumer payment systems, PAX Global ranked #4 globally by shipment volume of EFT-POS terminals. PAX’s EFT-POS products are sold to more than 70 countries and regions including the US, Singapore, Taiwan, Japan, South Korea, New Zealand, EMEA and Central Asia.

Bocom Keeps ‘Buy’ Call on SUNNY OPTICAL

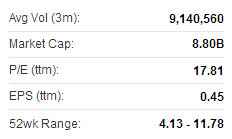

Bocom is maintaining its “Buy” recommendation on handset and camera lens assembly play Sunny Optical (HK: 2382) with a target price of 11.40 hkd (recent share price 8.00)

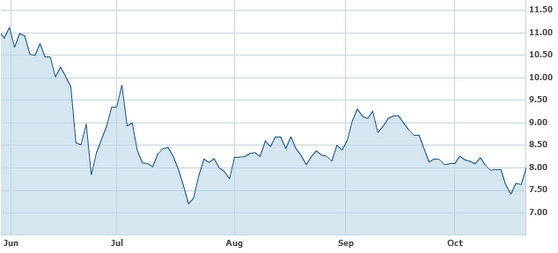

Sunny Optical's recent Hong Kong share performance. Source: Yahoo Finance

Sunny Optical's recent Hong Kong share performance. Source: Yahoo Finance

Sunny Optical’s September shipment volume of handset camera modules increased by 39.3% year-on-year in September, and 12% month-on-month, with the aggregate Jan-Sept shipment volume of handset camera modules up 50.2%.

The strong growth was mainly driven by the robust demand for smartphones,” said Bocom.

Sunny Optical recently 8.01 hkdShipment volume of handset lens sets increased by 6.9% year-on-year in September mainly due to the increased shipment volume to external customers, while shipment volume of spherical lenses down 54.4% year-on-year mainly due to weak demand for digital cameras.

Sunny Optical recently 8.01 hkdShipment volume of handset lens sets increased by 6.9% year-on-year in September mainly due to the increased shipment volume to external customers, while shipment volume of spherical lenses down 54.4% year-on-year mainly due to weak demand for digital cameras.

Sunny Optical made an announcement on October 18 that the flood-affected production facilities of handset camera modules, spherical lenses, vehicle lens sets and optical instruments/infrared related products in Yuyao City have resumed production at normal capacities.

The Hong Kong-listed firm added that around half of the production facilities of handset lens sets have resumed normal capacity.

“We believe the impact of the flooding is limited,” the research house added.

See also:

PAX'S 'Master' Plan