Daiwa: Good Momentum for CHINA AUTOS; ‘Positive’ on Sector

Daiwa Capital Markets said that a survey of China’s listed automakers suggests “good momentum” heading into the first quarter of 2013.

“The PBOC’s survey suggests more people intend to buy cars in the next three months,” said Daiwa.

The survey, commissioned by the country’s Central Bank, found that destocking continues and an import sales slowdown may narrow retail discounts further.

The December survey of consumers’ future car-buying intentions suggests that 15.4% of those interviewed are considering buying cars in the next three months, the highest level for nearly two years.

Car sales-volume growth should rebound to above 12% y-o-y for 1Q13.

“We note that there is a strong historical correlation between the PBOC’s quarterly survey results and y-o-y passenger vehicle (PV) sales volume growth in the subsequent five months.

“Although this year, the positive correlation between June’s survey result and PV sales-volume growth for June-November was weaker than in previous months, we believe this was due mainly to the sharp drop in Japanese car sales, which we estimate lowered PV sales over September-November by about 235,380 units (this could have provided additional 6% YoY growth for the period),” said Daiwa.

A wave of Chinese nationalism this year amid a territorial dispute with Japan has cut deeply into Japanese import numbers.

As the PBOC’s latest survey suggests that demand remains strong, the Japanese research house said it expects the lost sales between September-November to surface gradually in the coming months.

As such, it forecasts PV sales volume growth to rebound to above 12% y-o-y in 1Q13.

Destocking continues

For October, wholesale volume of imported PVs declined by 26% y-o-y while the blended ASP stayed flat.

“Given this, we believe dealers’ destocking of luxury imported cars is continuing but should approach an end around mid-February next year,” Daiwa said.

Price discounts narrow further

Daiwa’s recent market research indicates the average discount (measured by the difference between the retail price and the manufacturer’s suggested retail price [MSRP]) has narrowed further at dealers in first tier cities and coastal areas to -3.6% and -1.3%, respectively, from -4.3% and -2.6% the previous week.

“Combined with the destocking trend, we see scope for car buyers’ sentiment to improve further in the next few months, which should improve earnings visibility at dealers ahead of automakers.”

Daiwa has reaffirmed its “Positive” sector view and favors Brilliance Auto (HK: 1114, “Buy”) and Geely Auto (HK: 175, “Outperform”).

“The sector trades at a 2013E PER of 8.5x (based on our forecasts), and we expect a further rally with the China Automobile Dealers Association’s (CADA) release of November inventory data due by end-December likely to be a catalyst.

“As the current high season for sales is likely to end from mid-January, we would not rule out seeing some profit-taking then, but would consider the low season in February as a good re-entry point.”

See also:

BYD Auto Founder To Get Golden Parachute?

BYD AUTO: Buffett's Bumpy Bargain

CLSA: South China PROPERTY Heating Up

CLSA said this Christmas may turn out to be a “rather warm” one for developers the southern Chinese province of Guangdong and its provincial capital Guangzhou.

“Buyers have recently lined up in queues overnight when there is a new launch. Hundreds of units got sold in hours, and luxury end apartments worth RMB30mln plus each got sold out on launch,” CLSA said.

The French research house added it believes Guangzhou and Guangdong are mature markets driven by upgraders and upgraders are accelerating their purchase decisions as inventory peaks and supply pressure eases, and the pricing power starts to shift towards the developers.

It has “Buys” on Country Garden and Agile, both direct beneficiaries of the pickup in the South China market and “undemanding” in its valuation, trading at 6.4x and 7.0x FY13 and yielding 5.8% and 4.3% respectively.

“Investors should watch the South China market closely. Queues are forming in various projects in Guangzhou and Guangdong, and SHKP sold all of its priciest apartments, worth RMB30mln plus each, in Tianhe, upon launch,” said CLSA.

Vanke generated RMB1bln of sale in one day in its Panyu project.

Country Garden sold 1,000 units within three hours in its Nansha project, and Agile reportedly sold 183 out of its 260 units launched (70% sale through rate) in its high end Science City project generating RMB900mln.

See also:

CHINA/HK Property: What Do Big Research Houses Say?

What Slowdown? CHINA NEW TOWN Lands 533 Mln Yuan Deal

Jefferies: Great Time to Buy CR LAND

Jefferies said that despite policy headwinds, it was an ideal time to buy Hong Kong-listed property developer CR Land.

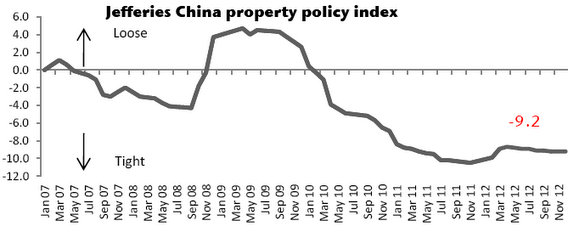

“The Chinese government reaffirmed a tightening stand, and Chinese property stocks were down 5% in a week on profit taking. More headwinds are likely in Tier 1 and Tier 2 cities as strong volume and land kings dominate the headline news.

"Equity placement is unlikely in next 6-9 months and we see a great buying opportunity for CR Land (-7.6% from recent peak),” Jefferies said.

At a recent Central Economic Conference in Beijing, the government reiterated that tightening measures over the property sector will continue in 2013.

The Ministry of Land vowed to maintain austerity measures to stabilize the land market.

“As transaction volume and ASP rallied strongly across major cities, we expect the new administration to maintain a tight grip on the residential market, and see no relaxation in 2013.”

Recent performance

Renhe rose 25% in five trading days; Yanlord (+8.2%) and CMP-B (+5.5%) outperformed; Shimao (-6.0%), CR Land (-4.7%), Powerlong (-4.3%) lagged peers.

YTD, the best performers are Greentown (+282%), Hopson (+200%), and Shenzhen Investment (+122%); the worst Renhe (-27%), Mingfa (-1.7%), and Glorious (1.5%).

SOHO, COLI, and Shimao were the most shorted stocks (30%/13%/12%) in mid-December.

“CR Land is our Top Pick in 2013. We prefer Hang Lung Properties and CMA as domestic consumption players,” said Jefferies.

See also:

HOUSE MONEY: Top 500 PRC Developers Assets Up 50% To 5 Trillion Yuan

THE HOUSE OF TRUTH: China Property Unstoppable?