Photo: Ansteel

Translated by Andrew Vanburen from a Chinese-language piece in Securities Daily

WE ARE TAUGHT to study history as well as learn from our own mistakes.

Business schools often urge us to study the successful firms and learn from their examples.

But there is also merit in looking into the biggest losers when earnings season rolls around every three months in China.

Here are the top three bourse busts so far this year.

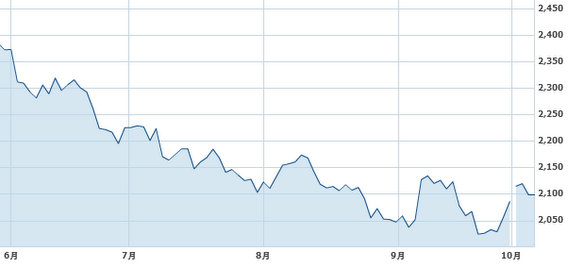

Angang New Steel Co Ltd (SZA: 000898; HK: 347) tops the charts for all the wrong reasons lately.

Thanks to the very unfamiliar sight of slowing growth and slumping demand for building materials at home in China, Angang’s January-September top line fell 16.3% year-on-year to 58.4 billion yuan.

As a sign that things are not even close to improving, the steelmaker’s third quarter revenue fell 18.8% from a year earlier to 19 billion yuan.

But the pain doesn’t end there.

The firm just announced in its quarterly earnings statement that it realized a net loss of 1.2 billion yuan in the July-September period, and was 3.2 billion yuan in the red for the first nine months of the year.

Angang placed the bulk of the blame on a weak market for steel products with a murky outlook for the sector.

It said that despite its best efforts to cut costs and improve efficiency, the sharp drops in selling prices for finished steel were too much to bear and resulted in even larger-than-anticipated losses.

The first three quarters saw China’s steel industry reach new recent lows, exacerbated by iron ore stockpiles that were suddenly depreciated thanks to plummeting contract prices.

Angang has been issued a warning of possible delisting by the Shenzhen Stock Exchange as any listco reporting losses in consecutive financial years is a possible candidate for expulsion from the bourse.

Investors should be very wary as Angang reported a loss in FY2011 and it is very unlikely that the steelmaker will be able to right the ship for the current calendar year.

Maanshan Iron & Steel Company Ltd (SHA: 600808, HK: 323) has had too much of a good thing for too long.

It’s been productive to a fault – overproductive in fact – and has been burdened with an excess inventory problem.

Maanshan’s January-September revenue slumped 9.6% year-on-year to just under 60 billion yuan.

The current Year of the Dragon has done little to breathe fire into its steelmaking furnaces, with the net loss over the first nine months standing at 3.1 billion yuan, and Maanshan was 1.2 billion in the red in the third quarter alone.

Despite gradually decreased output this year, the company still had a crippling inventory sitting idle, worth some 14.1 billion yuan by midyear.

It probably comes as no surprise that the third worst performer in a financial sense so far this year is also a steel play.

Anyang Iron & Steel Inc (SHA: 600569) realized a 2.4 billion yuan loss in the first three quarters, with revenue down nearly 39%.

See also:

POINTING FINGERS: ‘Immature’ Investors At Fault In China?

ONE MAN’S TRASH... Time To Look At ‘Garbage’ A-Shares?

CHINA CONSENSUS: Things Are Looking Up

CHANGING FACES: Five Sectors Turning Bullish