Aztech looks interesting – lowest forward PE among SG tech stocks with a 5.6% estimated dividend yield!

| This week, Aztech caught my attention amid rising volume with its 1QFY22F business update just around the corner. It has fallen approximately 39% from an intraday high of $1.56 on 27 Apr 2021 to close at $0.950 last Thursday. Let’s take a look on the interesting points and potential risks on Aztech. |

Interesting points

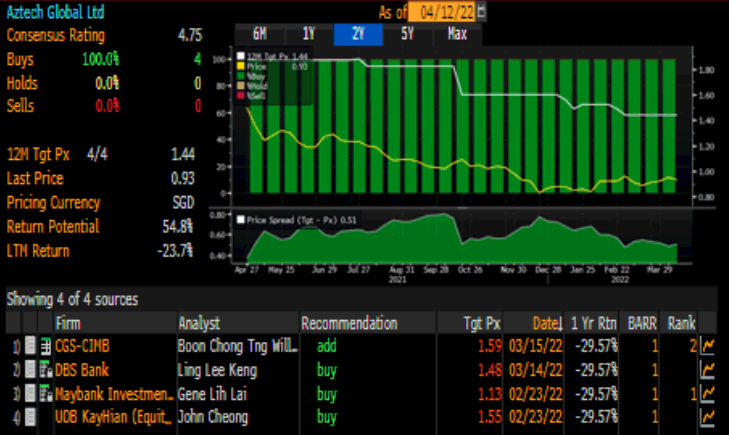

Analysts like Aztech with average target price $1.44

With reference to Figure 1 below, 4 analysts cover Aztech and all rate it a buy. Average analyst target price is around $1.44. If the analysts are right, Aztech offers a potential capital upside of around 52% compared to its closing price $0.950!

Fig 1: Aztech offers potential capital upside of around 52%

Source: Bloomberg 12 Apr 22

Attractive valuations

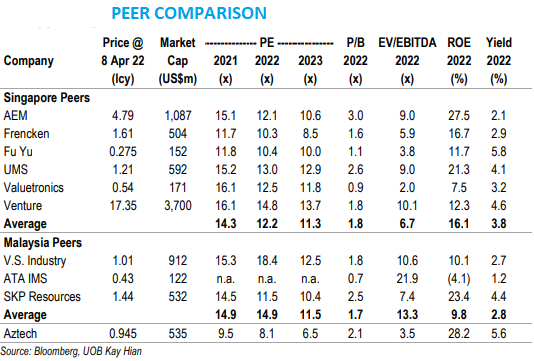

Based on UOB Kayhian tech report dated 11 Apr 22 (see Table 1 below), Aztech has the lowest forward FY22F PE valuation among tech shares at 8.1x. with the average around 12.2x.

Table 1: Aztech’s peer comparisons

Chart looks promising

Aztech seems to be on an uptrend. Volume has picked up over the past couple of days with 3.6m shares transacted on last Thursday vis-à-vis its average 30D volume of around 2.1m shares.

Aztech is trading above its short to medium term moving averages. ADX is starting to climb and last trades at 17.7 amid positively placed DI. A sustained breach above $0.960 with volume expansion is positive for the chart. Conversely, a sustained break below $0.920 with volume expansion is bearish.

Near term supports: $0.940 / 0.930 / 0.920

Near term resistances: $0.955 – 0.960 / 0.980 / 1.00 – 1.01

High dividend yield

Based on the same UOB Kayhian report, Aztech has the highest FY22F dividend yield of approximately 5.6% besides Fuyu. Furthermore, it is noteworthy that Aztech is going to ex div $0.05 / share on 6 May 22. Its AGM will be on 28 Apr.

1QFY22F business update scheduled on 18 Apr, after market

Aztech will be releasing its 1QFY22F business performance update on 18 Apr, after market. It will be interesting to see what the company is saying amid the on-going chip shortage, supply bottlenecks etc.

According to UOB KH research report (click HERE), they expect Aztech to report strong 1QFY22F earnings of $15m-17m which represents a 14% to 29% year on year improvement if the analyst is correct.

Net cash / share stands at $0.24 or 25% of market cap

Based on its FY21 results, Aztech has around $186.8 of net cash as of 31 Dec 2021. This translates to approximately 25% of its current market capitalisation of around $733.4m.

|

Risks

Due to time constraints, I have only outlined some risks only. The list below is definitely not an exhaustive list of risks.

a) Not extremely familiar in Aztech

Suffice to say that I’m not extremely familiar in the company. Clients can refer to the analyst reports HERE for more information.

b) Buying ahead of results is risky

As I have shared with my clients, buying a stock before its results release involves risks. There is no guarantee that the share price may rise even if it beats estimates or / & guidance. However, should it disappoint the market, odds are higher that the share price may fall.

Even if UOB Kayhian’s 1QFY22F net profit estimates of around $15m-17m are correct, this represents only around 17% - 19% of FY22F consensus net profit estimates polled by Bloomberg. Thus, market may not be able to assess whether Aztech can meet FY22F consensus net profit estimates of around $90.8m. Notwithstanding this, drawing reference from FY21 net profit records, 1Q is generally the weakest quarter.

c) Illiquid

Ave 30D volume transacted is only around 2.1m shares. On a few days, the volume transacted is lower than 1.0m shares. Suffice to say that it may not be easy to exit with minimal losses should we be wrong in our basis on Aztech.

There are other obvious risks such as business risks; Covid risks etc. Please refer to the analyst reports HERE for more information. |

Conclusion

Due to time constraints, this is just a brief write-up on my thoughts on Aztech. Personally, based on Aztech’s chart, its attractive valuations and upcoming 1QFY22F, odds are high that Aztech may trend higher.

I am vested in Aztech on a trading basis. Readers need to be aware that that Aztech is illiquid and buying ahead of results release is a risky event. Furthermore, I am not entirely familiar with Aztech’s fundamentals.

Readers should refer to Aztech’s announcements on SGX (click HERE) and Aztech’s analyst reports HERE.

As usual, readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE