Excerpts from KGI report

Analysts: Joel Ng & Chen Guangzhi, CFA

• Good start; even better second half. Rex International Holding (Rex) reported its highest semi-annual revenue since listing in 2013.

• Record free cash flows. Free cash flow generated by oil and gas companies are expected to break records this year with oil currently close to US$70 per barrel. For Rex, the windfall will continue to strengthen its already strong balance sheet and give it opportunities to diversify. • We maintain an Outperform recommendation while raising our DCF-backed target price to S$0.33, factoring in higher production from Oman. |

||||

Good first half. Rex reported a 1H2021 PATMI of US$23.9mn, making up 21% of our updated full-year forecast of US$115.3mn.

This is line with our expectations as Rex will benefit from the full effect of higher oil prices and contribution from Brage in the second half of 2021.

Net cash (Cash + quoted investments - debt) strengthened to US$21.3mn as at end June 2021. The group generated positive operating cash flows of US$17.8mn and spent US$22.0mn on E&P capex. Its net cash should be at least US$42mn higher (net to Rex as per our estimates) given that it only received the sale of oil from three liftings in July and August 2021. KGI estimates the Brage acquistion will translate to around US$20mn free cash flow net to Rex in 2021.

KGI estimates the Brage acquistion will translate to around US$20mn free cash flow net to Rex in 2021.

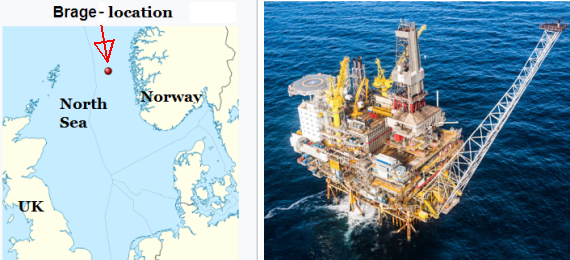

Even better going forward. The acquisition of the 33.84% interest in the oil producing Brage Field in Norway will be effective from 1 January 2021, after approval from the Norwegian authorities.

Brage Field will add around 3.4k barrels of oil production per day net to Rex’s subsidiary, Lime Petroleum. We estimate this will translate to around US$20mn free cash flow net to Rex in 2021.

The acquisition will be funded by the US$60mn senior secured bond that was fully subscribed back in June 2021.

For the year ahead, based on US$65 oil price, we forecast Rex’s net cash position to surge to US$107mn by FY2022F. This is equivalent to S$144mn or 58% of the group’s current market capitalisation (based on 19.2 Sing cents share price).

We are bullish on oil prices. Rex’s average realised oil price was US$62 per barrel in 1H2021, an increase from US$23 per barrel in 1H2020.

Brent oil prices have remained resilient above US$68 per barrel since May, despite concerns over rising Covid cases in China. While China has recently reduced oil imports, it is at the expense of drawing down its onshore storage levels. Hence, China will eventually have to begin increasing oil imports later this year. Furthermore, global crude inventories continue to decline.

Overall, we should see a positive tailwind to oil prices driven by China’s resumption of oil imports going into the fourth quarter, as well as an accelerating economic recovery in 2022.

Neglected sector…but where opportunities abound. Rystad Energy, an energy consultancy firm, projects that with oil trading around US$70 per barrel, the world’s publicly traded exploration and production (E&P) companies are set to generate record-breaking free cash flows in 2021.

Their combined free cash flows is expected to surge to US$348bn in 2021, from a previous high of US$311bn back in 2008, as per Rystad’s estimates.

| Valuation & Action: We maintain an Outperform recommendation while raising our TP to S$0.33, based on discounted cash flow with a WACC of 11.0%. Rex’s strong balance sheet, free cash flow generation and access to capital, differentiates it from many other E&P companies. Rex is the only game in town (at least on the SGX) for investors looking for direct exposure to the neglected O&G sector. |

Risks: The direction of oil price is the biggest driving factor of profits. U.S. shale production represents the largest supply variable. There is an ongoing claim against two of Rex’s subsidiaries in Oman; Rex has assessed that there will be no material financial impact from the claim.

Full report here