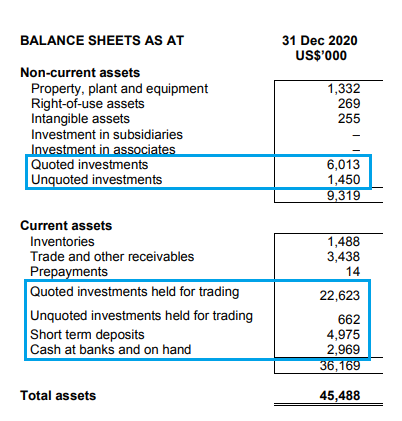

Trek 2000 has an enviable balance sheet: Zero borrowings and nearly US$39 million (about S$52 million) in real solid assets which comprise cash, bonds, quoted and unquoted funds (as highlighted below).

Its NAV as at end-FY2020 was 12.52 US cents, or 16.7 SGD cents.

That's still above its current trading stock price of 13.6 cents.

Trek 2000 has publicised its response to questions from the Securities Investors Association of Singapore ahead of Trek's AGM. Excerpts:

| Can the board help shareholders understand if it had approved the company’s investment into funds and quoted equities? |

A: All investments undertaken by the Group are approved by the Board.

| Would the size of the investments (US$30.7 million compared to US$39.6 million in equity) significantly alter the risk profile of the Group? |

A: The risk profile of the Group remained relatively unchanged as the Group adopts the appropriate risk management measures to safeguard its investment as explained at the SGXNET on 2 September 2020. To reiterate again, the risk management measures adopted by the Group are as follows:

All investments to be put in by the Group are recommended by its appointed Investment Bankers, primarily Credit Suisse AG, an international bank and accredited financial adviser with MAS, and other appointed Investment Bankers accredited with MAS, and approved by the Board. The appointment of Investment Bankers is approved by the Board. The investments are diversified in equity, bonds and funds.

The investment assets recommended have historical yields that meet the targeted returns of the Group.

The investment assets shall be in safe investments preferably with ratings of “BBB” and above.

The Group ensures a diversified portfolio of its investments to minimize the investment risks.

Investments are in financial assets that the Group is able to liquidate at short notice by selling the investments to the professional fund managers if it wants to liquidate the investments.

Periodic reviews of the yields and returns of the investment portfolio and assessment of the performance are carried out with the financial advisers.

| What are the criteria applied in the evaluation and selection process of these funds? |

A: As mentioned above, all recommended investment opportunities will need to come from appointed Investment Bankers, have historical yields that meet the targeted returns of the Group and shall be in safe investments preferably with ratings of “BBB” and above. The Group also ensures a diversified portfolio to minimize the investment risks.

Trek 2000 is an industry leader, innovator, original inventor and patent owner of the ThumbDrive® (i.e. USB Flash Drive) and FluCard®, board director of SD Card Association and co-chairman of iSDIO forum. It offers state-of-the-art design solutions ranging from Interactive Consumer Solutions, Wireless, Anti-piracy, Compression and Encryption to sophisticated Enterprise Solutions all catering to the fast changing digital industry.