Excerpts from KGI report

| Laggard COVID-19 play • The V-shape recovery in the housing market in Canada and US has been driven by people moving away from cities, and towards suburban areas.

• Avarga’s main business contributor, Taiga Building Products (70.8% ownership), runs a business of lumber and other building materials distribution, benefiting from the high lumber prices. • We do not have an official rating but estimate a fair value of S$0.43 based on 10x FY2020F P/E. Earnings this year will largely be driven by Taiga’s 2H20 performance. Potential further upside if it is able to monetise its two other businesses in Asia, which we have not included in our fair value estimates. |

||||||

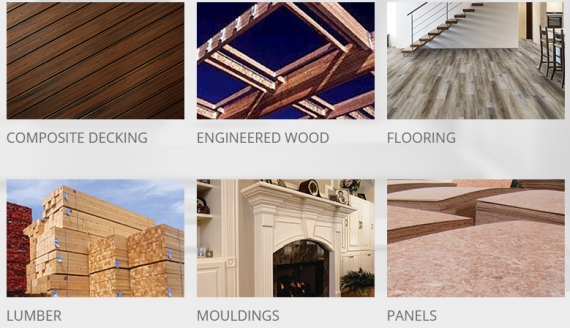

Examples of Taiga's products whose inventory has gone up in value with market prices. Photo: Company

Examples of Taiga's products whose inventory has gone up in value with market prices. Photo: Company

Housing market bonanza. In the current recession, most savings and investments are not hit as badly as during the global financial crisis. Work from home, low interest rates, and government aid have favoured the housing market as people move out of major cities to avoid infections.

Lumber going through the roof. Lumber prices have skyrocketed due to supply shortage and strong demand.

Inventory level of lumber is declining rapidly while quite a few saw mills have yet to resume operations in Canada.

| Jackpot for Taiga. The increase in lumber price gives Taiga the ability to charge a higher mark-up on products, as well as earn extra gross profits from earlier inventory that was stocked at lower prices. -- KGI report |

Valuation & Action: We think a fair value of S$0.43 is the minimum for Avarga.

We utilise a 10x FY2020F P/E, which is based on the 3-year historical average of Avarga.

Avarga’s crown jewel is its 70.8%-owned Canadian-listed building material distribution company - Taiga Building Products (TBL CN).

We forecast Taiga’s 3Q20 earnings to jump 78% QoQ as it benefits from higher lumber prices and strong demand, but conservatively estimate that 4Q20 will drop 44% QoQ on the back of a seasonally weak 4Q.

As a result, we estimate profits after minority interest of at least S$41mn for Avarga in FY2020F.

Our fair value does not include the value of Avarga’s two other businesses (paper manufacturing and power plant in Myanmar), and hence we believe that our valuation is on the conservative side.

After June 2020, the price started to take off. Such an exponential growth in a few months’ time is attributable to the mismatch between supply and demand. Lumber market is facing shortage of supply because of shut-down of sawmills that treat the wood due to COVID-19 restriction of labour density in Canada. Meanwhile, the home building demand is picking up rapidly at the moment. The inventories of building materials, especially lumber has been substantially declining since April while the wholesale sales presented a V-shape rebound.

-- KGI report

| Risks: The performance of Taiga depends on the demand for building materials and lumber price. In the short term, the saw mills could speed up the resumption of operation to capture the high selling price of lumber. The housing demand could taper when COVID-19 is completely contained, and work from office is back to pre-COVID period. |