| Despite severe disruptions to business operations and cross-border movement of goods and people, Chasen Holdings continued to secure new projects for its core businesses in Specialist Relocation and Third Party Logistics. Chasen said its Specialist Relocation business segment has bagged projects in the People’s Republic of China, Malaysia and Singapore.  Chasen workers relocating sophisticated machinery. This requires state-of-the-art material handling equipment and specialised worker skills. Chasen workers relocating sophisticated machinery. This requires state-of-the-art material handling equipment and specialised worker skills. Photo: Company Its Technical & Engineering business has secured a steel fabrication cum installation project in spite of the post-Circuit Breaker challenges in Singapore. The total value of the contracts is S$21 million. |

Chasen said the robustness of the manufacturing sectors related to semi-conductors, solar panels and TFT LCDs in Singapore, Malaysia and the PRC presented new business opportunities for the Group.

| "New developments in the operational requirements of manufacturers as a result of the volatile global market have coalesced our two business segments, allowing Chasen to provide a more holistic suite of services for the customers." -- Chasen Holdings |

Chasen’s PRC-based subsidiary Chasen (Chuzhou) Hi-Tech Machinery Services Pte Ltd will provide move-in services for a new 8.5th Generation TFT LCD manufacturing plant cum OLED R&D facility being established in Changsha, Hunan Province.

The project is worth RMB50 million or approximately S$9.95 million and the revenue is expected to be earned over a 12- month period commencing in the last quarter of 2020.

|

Stock price |

5.8 c |

|

52-week |

3.4 – 9.4 c |

|

PE (ttm) |

- |

|

Market cap |

S$23 m |

|

Price-to- book |

0.4 |

|

Dividend |

5% |

|

1-year return |

- 34% |

In Malaysia, the Group’s Penang-based subsidiary, Chasen Logistics Sdn Bhd, will provide relocation services for a US MNC solar panel and a US semi-conductor manufacturing plant in Kulim Hi-Tech Park and Perai respectively.

The semi-conductor contract is for the first phase with two more phases to follow.

Both contracts are worth an aggregate RM9.43 million or approximately S$3.08 million, and will run from July 2020 to March 2021.

In Singapore, the Group’s pioneer relocation subsidiary, Chasen Logistics Services Limited, secured several projects to provide move-in, crating and packing services, as well as crossborder services for locally-based MNCs in the semi-conductor and solar panel manufacturing industries.

These projects are worth a total of S$2.96 million and will run between April and September 2020.

Despite the downturn and slow opening up of the construction industry post-CB, Chasen’s T&E subsidiary, Hup Lian Engineering Pte Ltd clinched a project for steel fabrication cum installation of solar panels worth S$5 million.

The preliminary stage of this one-year project commenced recently.

The Group expects these projects to have a positive financial impact from the second half of calendar year 2020.

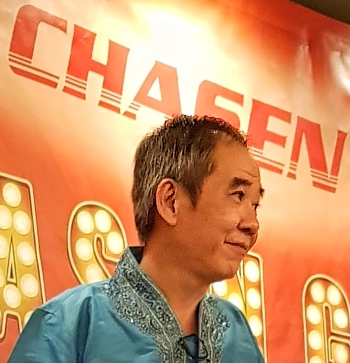

Mr Low Weng Fatt (photo), Chasen’s Managing Director and CEO, said, “We remain committed to overcoming adversity and will continue to secure new projects in our core, niche businesses in Specialist Relocation and cross-border land freight. Our unique position as a market leader in these sectors will enable the Group to draw in more business opportunities in the improving economic situation following the outbreak in the region. Despite the earlier shutdown of the local construction industry during the CB, our T&E segment has also proven itself to be resilient by securing such a sizeable project.” Mr Low Weng Fatt (photo), Chasen’s Managing Director and CEO, said, “We remain committed to overcoming adversity and will continue to secure new projects in our core, niche businesses in Specialist Relocation and cross-border land freight. Our unique position as a market leader in these sectors will enable the Group to draw in more business opportunities in the improving economic situation following the outbreak in the region. Despite the earlier shutdown of the local construction industry during the CB, our T&E segment has also proven itself to be resilient by securing such a sizeable project.” |

The Group's revenue for the financial year ended 31 March 2020 was $30.9 million (or 23% lower than in FY2019 mainly due to lower revenue recognised by the Specialist Relocation Business Segment and the Technical and Engineering Business Segment.

This was offset by higher revenue from the Third Party Logistics Business Segment.

The COVID-19 pandemic which broke out in the last quarter of FY2020 significantly affected the Group's revenue in China as projects were delayed.

Chasen reported a loss after income tax for FY2020 of $15.5 million (FY19: $5.4 million net profit).