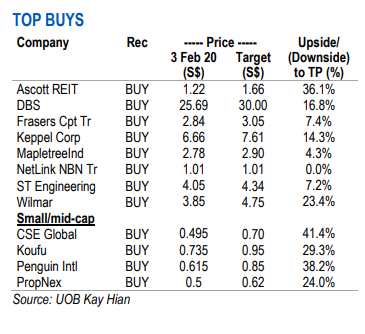

Excerpts from UOB Kay Hian report

Analysts: Adrian Loh and the Singapore Research Team

| Keeping An Eye Out For Bargains Our base-case view is that the 2019 novel coronavirus (nCoV) will likely peter out by mid-year.  We point out that medical experts have indicated that the mortality rate for this strain of virus is less lethal than SARS (2003), H1N1 (2009) and MERS (2015) but infection rates have been relatively high. We point out that medical experts have indicated that the mortality rate for this strain of virus is less lethal than SARS (2003), H1N1 (2009) and MERS (2015) but infection rates have been relatively high. Given the STI’s 4% decline since 20 Jan 20, we identify stocks that are: c.10% away from their 52-week lows, trading at -1SD or below their historical 5-year PE and P/B valuations, and have a >4% 2020 yield. |

WHAT’S NEW

• With fresh newsflow on nCoV on a daily basis, markets have been spooked and investors remain cautious, in our view.

As a result, regional indices have been weak and the STI has not been spared.

However, we believe that the Singapore government is better prepared now compared with prior viral outbreaks, and thus should be able to contain the spread of nCoV.

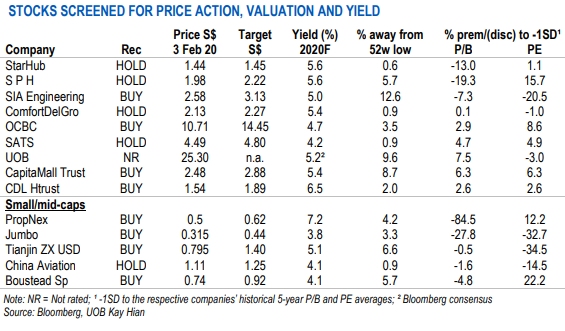

• Stocks have retraced – Looking for entry points. With some of the stocks in our coverage universe suffering double-digit losses ytd, we have identified stocks that are:

| a) approximately 10% away from their 52-week lows, b) trading at -1SD or below their historical 5-year PE and P/B valuations, and c) have a >4% dividend yield for 2020. |

The results are shown in the table below:

Adrian Loh, analyst.• Common themes. The above companies that fit into our screening criteria appear to largely fit into the following sectors: aviation, hospitality, and consumer-related stocks. Adrian Loh, analyst.• Common themes. The above companies that fit into our screening criteria appear to largely fit into the following sectors: aviation, hospitality, and consumer-related stocks. We believe that should nCoV be successfully contained and the infection and mortality rates plateau, these stocks are likely to stage a relief rally in the next 3-6 months, irrespective of whether the companies’ 2020 earnings take a hit. |

• Yield ‘protection’. While we acknowledge that the companies listed above could see lower dividends in the face of lower yoy earnings in 2020, companies with sustainable earnings this year include banks and telcos.

Full report here.