Sim Wee Ming contributed this article to NextInsight

As a long-time shareholder, I did push my point on the company’s capital structure at past AGMs.

Powermatic Data has a happy problem with lots of cash on its balance sheet and zero debt:

|

Financial year

|

Cash (‘000)

|

|

FY2019

|

$35,151

|

|

FY2018

|

$27,346

|

|

FY2017

|

$25,948

|

|

FY2016

|

$21,066

|

Powermatic has seen strong shareholder turnout at its recent AGMs. NextInsight photoI was not too excited by the low return on equity of 12.35% for 2019 and 8.45% for 2018 on its high cash level and low working capital requirement for its wireless connectivity business.

Powermatic has seen strong shareholder turnout at its recent AGMs. NextInsight photoI was not too excited by the low return on equity of 12.35% for 2019 and 8.45% for 2018 on its high cash level and low working capital requirement for its wireless connectivity business.

Powermatic owns a freehold property which it bought in 2010 and it has since appreciated to about S$35 million.

It’s a completely paid up investment.

I am happy that the company recently announced it has engaged professional advisors to review its capital structure. (See: POWERMATIC DATA: Flags big profit jump, reviews capital structure)

My wish list is:

- Excess cash: Powermatic has been distributing rising dividends, but I hope it will consider distributing more of the excess cash to shareholders by means of dividends.

This was also brought up in past AGMs.

|

Financial year

|

Ordinary dividend

|

Special dividend

|

|

FY2019

|

5 c

|

3 c

|

|

FY2018

|

5 c

|

2 c

|

|

FY2017

|

5 c

|

2 c

|

|

FY2016

|

5 c

|

-

|

Related to that, we don't understand the low retained cash ($12.8 million as at end-FY19) at the company level.

I wish the company can bring earnings back from its overseas units if there is no immediate capex need.

The company has so far been operating on a low capital requirement for growth.

In FY2019, it bought a manufacturing facility in Kulai, Malaysia, to diversify its manufacturing base from China owing to customer concerns about the US-China trade war.

(The capex: Only S$1.6 mil)

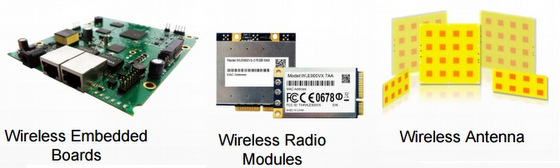

Powermatic designs and manufactures high performance wireless communication devices and software. Powermatic designs and manufactures high performance wireless communication devices and software.

- Investment property: I wish the company would sell it at an interesting market value (of at least $50mil, which was what it apparently was offered in 2017).

Alternatively, it can take on some leverage on the property in Harrison Road in order to return more cash to shareholder and reduce the equity on the property.

Powermatic can consider selling the property to a Reit etc to release capital on the property.

In any case, it’s better to have a capital structure where we can enjoy the property with lower equity locked into the property.

The rental yield on the property is around 1.6%.

It's low but we can consider keeping the property long term as there is potential development opportunity in the area when Paya Lebar Airbase moves out of the area.

|

|

What’s my fair value for Powermatic (recent stock price: $2.55)?

Around $3.70 or more once the value of the property is realised.

As I consider its wireless business a growing one, I value it at a PE of 15x, which means $3.00 per share.

(Its growth last year was 30%, and the current year probably 30%++. With the coming 5G era, Powermatic's growth potential is even better going forward).

Its cash level is about $1.00 per share as at FY 2019. Property at $50Mil is worth $1.40 in share price if sold.

"Other investment" is not material at $6.3mil.

Total ($3+ $1.00 + $1.4 = $5.40. Applying a discount of 30%, the value is $3.78)

|

Powermatic has seen strong shareholder turnout at its recent AGMs. NextInsight photoI was not too excited by the low return on equity of 12.35% for 2019 and 8.45% for 2018 on its high cash level and low working capital requirement for its wireless connectivity business.

Powermatic has seen strong shareholder turnout at its recent AGMs. NextInsight photoI was not too excited by the low return on equity of 12.35% for 2019 and 8.45% for 2018 on its high cash level and low working capital requirement for its wireless connectivity business.