Loke Wai San, the man credited with the high-profile success of AEM Holdings in recent years, is betting that ISDN Holdings is an undiscovered gem.

ISDN announced yesterday the subscription of 26,987,295 shares by a private equity fund managed by Mr Loke for a 6.4% stake in ISDN. Mr Loke is the founder and managing partner of Novo Tellus Capital Partners -- and executive chairman of AEM Holdings, a portfolio company of Novo Tellus. |

||||||||||||||||

The Novo Tellus investment is expected to close in April 2019.

The share issue price is 20 cents, which will raise gross proceeds of S$5.4 million (net proceeds: S$5.3 million) to finance ISDN’s growth strategy in serving Asia’s advanced manufacturing and clean energy sectors.

By no means is it a massive cash infusion. But the ISDN-Novo Tellus partnership could do some wonders for both.

ISDN joins a select number of investee companies of Novo Tellus whose website lists only 5 (including AEM).

The Novo Tellus website says: "We favor a small portfolio of investments, allowing us to spend more time partnering with management teams to build lasting growth and value in our businesses. Our approach to building companies to last works: Our companies on average increase their value by well over 300% after a Novo Tellus investment."

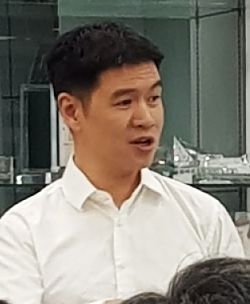

Loke Wai San, managing partner of Novo Tellus Capital Partners. Loke Wai San, managing partner of Novo Tellus Capital Partners. NextInsight file photo.“Our Fund invests in rising stars in Southeast Asia’s manufacturing and industrial economy and ISDN presents a compelling opportunity to invest behind the transformation underway in Asia’s factories. "It’s clear that Asia’s industrial producers are embracing greater levels of automation and increasingly moving towards Industry 4.0 manufacturing practices. "Indeed, the industrial automation market in Asia is estimated to exceed S$40 billion by 2020. "ISDN is uniquely positioned to capitalise on this vast market opportunity: it has already delivered automation solutions to over 10,000 industrial customers to date, and its deep customer relationships, advanced engineering capabilities, and strategic market presence in key manufacturing markets like China, Thailand, Vietnam, Singapore, Hong Kong and Malaysia should enable the Company to serve the increasingly sophisticated automation needs of Asia’s manufacturing industry.” -- Loke Wai San (Source: Press release) |

“We are pleased that Novo Tellus has invested in shares alongside our public investors, providing a strong signal of confidence in the Company’s prospects and alignment between all of our investors. “We are pleased that Novo Tellus has invested in shares alongside our public investors, providing a strong signal of confidence in the Company’s prospects and alignment between all of our investors. "Our extensive discussions with the Fund have confirmed its deep expertise in our core business sectors and we look forward to Novo Tellus’ contributions to ISDN through its investment and [potential] board directorship.” -- Teo Cher Koon, ISDN’s MD and President |

ISDN’s Managing Director and President Mr. Teo Cher Koon said: “The investment by a leading sector investor with a long-term focus validates ISDN’s strategy of building solid competitive strengths in attractive markets that have lasting growth momentum.

"Moreover, Novo Tellus has built an impressive track record in creating positive and growth-oriented partnerships with management teams to solidify core strategy, focus business execution, and build lasting investor support.”

Mr Keith Toh, Partner at Novo Tellus, said: “In addition to its proven strengths in automation, ISDN embeds an attractive emerging opportunity with its hydropower investments in Indonesia: an archipelago well-suited to local power generation from small and mid-sized hydropower plants.”

Keith Toh, Partner, Novo Tellus. NextInsight photo“ISDN has kept a low profile in the public market while patiently building its core automation business and developing its emerging energy business.

Keith Toh, Partner, Novo Tellus. NextInsight photo“ISDN has kept a low profile in the public market while patiently building its core automation business and developing its emerging energy business.

"We believe investors will increasingly see the results of the Company’s patient strategy in the coming years, and we look forward to a partnership with ISDN that helps realise strong returns to ISDN’s solid positions in the attractive industrial automation and clean energy markets.”  A hydropower project being developed by ISDN in Indonesia. Photo: Company

A hydropower project being developed by ISDN in Indonesia. Photo: Company