Excerpts from Maybank Kim Eng report

Analyst: Lai Gene Lih, CFA

| After the rain comes a rainbow Strong 2020E after 2019E speed-bump; Initiate BUY We model a base case scenario where 2020E earnings could rebound 133% YoY following a 51% slump in 2019E, driven by i) a potential recovery of HDMT test handler (TH) deliveries, and ii) production ramp-up from new customers.

Initiate with BUY with ROE-g/COE-g TP of SGD1.21, based on 2.9x average 2019-20E P/B, based on 2019-20E average ROE of 27.3%, COE of 10.6% and LTG of 2%. Our TP implies 2020E EV/EBITDA of 5.2x, vs. peers’ at 9.6x. |

||||

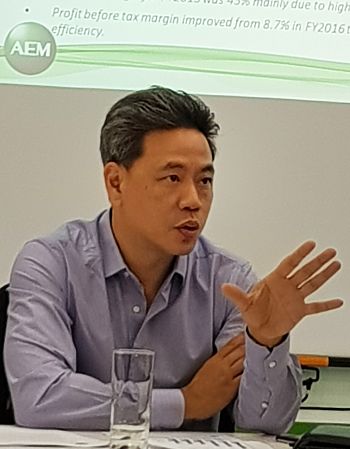

Loke Wai San, executive chairman, AEM. NextInsight file photoHDMT recovery in 2020E

Loke Wai San, executive chairman, AEM. NextInsight file photoHDMT recovery in 2020E

Following two strong years of production ramp-up, HDMT TH orders are expected to be tempered by slower operational fleet replacement.

However, we believe deliveries in 2020E could pick up as the core customer completes its capacity expansion in Israel.

Concomitantly, the customer has re-affirmed the timelines of new chips manufactured on its new 10nm process, which we believe bodes well for AEM’s prospects. We currently forecast HDMT TH shipments of 44/17/35 in 2018-20E.

However, we may have to update our earnings forecasts as and when AEM updates on 2019E guidance.

Still lucrative with core customer

Thanks to AEM’s strong execution, it has been selected to work with the customer on various other initiatives, including a next-gen hybrid solutions product. Meanwhile, the progress of the core customer’s 10nm process, R&D (2017: USD13b) that is head-and-shoulders ahead of peers, and strong portfolio of IPs and chip manufacturing know-how suggests that the customer’s competitive advantages are intact.

Diversification underway

Since 2017, AEM has acquired three companies and introduced its own inhouse modular and massively parallel test handling solutions AMPS. With these, AEM has secured at least three customers. Development and customisation for these products are already underway. Management expects production ramp-ups in 2020E.

Lai Gene Lih, CFAValuation Lai Gene Lih, CFAValuationWe believe our TP is reasonable, as it implies 8.2x 2020E P/E, for earnings growth of 133%, while global test handling peers are trading at 11.7x for growth of 33%. On a 2019E basis, our TP implies 19.1x while peers are trading at 14.3x.We believe our TP is reasonable, as it implies 8.2x 2020E P/E, for earnings growth of 133%, while global test handling peers are trading at 11.7x for growth of 33%. If our base case scenario plays out, we expect AEM’s cash position to account for 27% of its market cap by 2020E. This implies that AEM is currently trading at only 4.5x ex-cash 2020E P/E. AEM’s share price may be volatile in 2019, especially considering the softer than expected outlook of its key customer at its 4Q18 earnings briefing. However, disclosures by the customer suggest that the weakness is transient, and that its secular prospects are intact. Moreover, given the earnings tailwinds we see for AEM in 2020, we would be BUY-ers on dips. |

Full report here.