Excerpts from UOB Kay Hian report

Analyst: John Cheong

| Takeover Could Drive Re-rating Of Deep-Value Small-Cap Manufacturing Stocks The takeover offer of PCI on 4 Jan 19 at an attractive premium and TTM EV/EBITDA of 5.5x could lead to a re-rating of deep-value manufacturing stocks.

Our top picks are Fu Yu (2019FEV/EBITDA of 2.9x and yield of 8.7%) and Valuetronics (2019F EV/EBITDA of 2.7x and yield of 6.3%). Assuming 5.5x EV/EBITDA, both stocks could offer about 80% upside. |

||||||||||||||||||||

WHAT’S NEW

• PCI received a takeover offer from Platinum on 4 Jan 19. On 4 Jan 19, PCI announced that it had received a takeover offer from Platinum at an offer price of S$1.33 per share, apremium of 60.1% over the volume weighted average price of the shares for the 12-month period up to the last undisturbed trading day of 17 Sep 18.

The valuation metrics of 5.5xTTM EV/EBITDA based on the offer price appears to be 19.6% higher than small-capmanufacturing peers’ 4.6x 2018F.

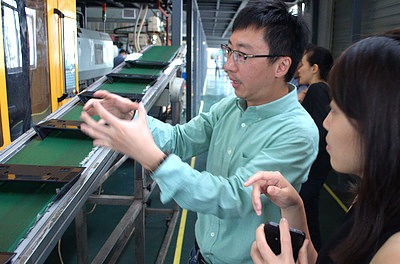

STOCK IMPACT Memtech executive director TM Chuang showing investors around the company's factory in China. NextInsight file photo.• Deep-value small-cap manufacturing stocks re-rated on the news. After the announcement of this deal, we note that several small cap manufacturing names re-rated upward on 7 Jan 18:

Memtech executive director TM Chuang showing investors around the company's factory in China. NextInsight file photo.• Deep-value small-cap manufacturing stocks re-rated on the news. After the announcement of this deal, we note that several small cap manufacturing names re-rated upward on 7 Jan 18:

a) Fu Yu (+2.7%), b) Valuetronics (+2.2%), c) Sunningdale (+2.8%), d)Memtech (+4.6%), and e) Hi-P (+12.2%).

We think that the deal could serve as a reminder of good value in Singapore’s small-cap manufacturing space.

• High margin of safety provides more room for further re-rating. We believe deep-value names with a high margin of safety have room for further re-rating, especially in the current uncertain macroeconomic environment which faces risks of trade war and slower growth. Companies with high cash reserve and dividend yield can weather any downturn better than their peers.

John Cheong • Our top picks are Fu Yu and Valuetronics. Fu Yu and Valuetronics are the only BUYs among small-cap manufacturing companies under our coverage. Their valuations remain attractive and investors could receive generous dividend yield while waiting for any catalysts, including takeovers, cost rationalisation and huge order wins: John Cheong • Our top picks are Fu Yu and Valuetronics. Fu Yu and Valuetronics are the only BUYs among small-cap manufacturing companies under our coverage. Their valuations remain attractive and investors could receive generous dividend yield while waiting for any catalysts, including takeovers, cost rationalisation and huge order wins: a) Fu Yu trades at at 2.9x 2019F EV/EBITDA and 2019F ex-cash PE of 6.0x. Its net cash has continued to increase to S$75.3, or 52% of its market cap. Fu Yu is diversifying to a more stable business model and is optimising as well as turning around its loss-making operations. b) Valuetronics trades at 2.7x 2019F EV/EBITDA and 2019F ex-cash PE of 4.0x. Its net cash has continued to increase to S$152.7m, or 51% of its market cap. Valuetronics continues to see good demand for connectivity modules used in the automobile industry. |

EARNINGS REVISION/RISK

• We maintain our EPS forecasts.

• Risks include forex, lower-than expected orders, and margin pressure from rising costs.

VALUATION/RECOMMENDATION

• We maintain BUY and target prices for Fu Yu and Valuetronics.

• Our target price of S$0.27 for Fu Yu is based on 5.3x 2019F EV/EBITDA, pegged to peers’ average.

• Our target price of S$0.87 for Valuetronics is pegged to peers’ average of 10.9x 2019F PE.

SHARE PRICE CATALYST

• Additional customers or better cost savings.

• Higher-than-expected dividends.

• Potential takeover offer.

Full report here.

See also: PCI LIMITED: Takeover offer on table, how much have you made?