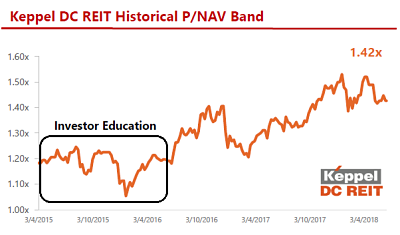

| This month (July) is the second anniversary of EC World REIT's listing on the Singapore Exchange. Its unit price, at 72 cents recently translates into an annualised yield of 8.4%. The unit price has touched the lowest point in two years -- but could this be the bottom?  The REIT's under-performance vis-a-vis its IPO price of 81 cents is not a rare event in the early experience of many REITs. The REIT's under-performance vis-a-vis its IPO price of 81 cents is not a rare event in the early experience of many REITs. Just look at Keppel DC REIT, a comparable in the sense that it too has assets that are specialised (data centres). Keppel DC REIT, which needed about a year and a half for investors to re-rate it strongly, now trades at 1.4X book value (see chart). |

EC World REIT CEO Goh Toh Sim speaking with about 150 investors last week. NextInsight photo.EC World has stepped up its investor education: In June alone, the management took to three events to share the REIT's story (see photos from EC World's Facebook page).

EC World REIT CEO Goh Toh Sim speaking with about 150 investors last week. NextInsight photo.EC World has stepped up its investor education: In June alone, the management took to three events to share the REIT's story (see photos from EC World's Facebook page).  L-R: Li Jinbo, Head of Investments, Asset Management and Investor Relations | Johnnie Tng, CFO | Goh Toh Sim, CEO | Gabriel Yap, chairman of GCP Global. Photo: GCP GlobalWe attended one organised recently by GCP Global.

L-R: Li Jinbo, Head of Investments, Asset Management and Investor Relations | Johnnie Tng, CFO | Goh Toh Sim, CEO | Gabriel Yap, chairman of GCP Global. Photo: GCP GlobalWe attended one organised recently by GCP Global.

EC World describes the majority of its asset portfolio as being specialised as it comprises a Hangzhou inland river port that handles steel for urbanisation projects and warehouses (also in China) that support the logistics of e-commerce players.

Unlike conventional warehouses that chiefly store boxes, EC World's warehouses are equipped to rapidly move inventory.

The customer's significant investment in the infrastructure lends a customer stickiness for the REIT. Similarly, for its port.

For an idea of what an e-commerce warehouse is about, watch this video of JD.com, which leases one of EC World's warehouses -->

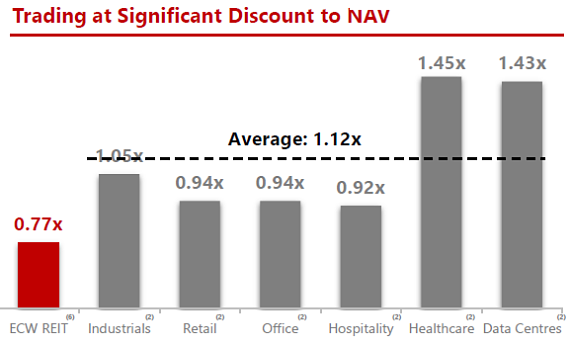

REITs with specialised asset portfolios tend to trade at higher valuations, noted Li Jinbo, the REIT's Head of Investment, Asset Management and Investor Relations.

Three such REITs -- Keppel DC REIT, First REIT and Parkwaylife REIT -- had an average P/B value of 1.43 as at 19 June 2018.

It was only 0.77 for EC World, unfortunately, but Mr Li optimistically said: "There is potential for revaluation of our REIT once the market appreciates the differentiation in our assets."

L-R: Johnnie Tng, CFO | Goh Toh Sim, CEO | Li Jinbo, Head of Investments, Asset Management and Investor Relations. Photo: GCP Global There is a further positive about EC World: Its management fee is directly tied to the REIT’s performance and unitholders’ interest:

L-R: Johnnie Tng, CFO | Goh Toh Sim, CEO | Li Jinbo, Head of Investments, Asset Management and Investor Relations. Photo: GCP Global There is a further positive about EC World: Its management fee is directly tied to the REIT’s performance and unitholders’ interest:

♦ Management fee: It is 10% of distributable income payable to unitholders. In contract, in a typical REIT, the management base fee is a percentage of the assets under management.

♦ Performance Fee: It is 25% of the year-on-year incremental distribution per unit (DPU), so if the DPU doesn't grow, neither does the performance fee.

In contrast, in a typical REIT, it is a percentage of net property income -- which is the figure before financing costs and other expenses.

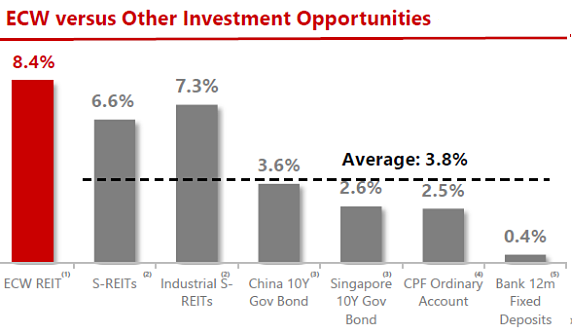

| With a recent acquisition in Wuhan, EC World has got on the path to growing its DPU. (See: EC WORLD REIT: "Sponsor's asset ripe for injection into REIT," says analyst) It has a relatively low gearing of 28.9% which implies about S$220m of debt headroom (40% optimal gearing) for future acquisitions. These could be of assets of EC World's sponsor and/or logistics real estate assets of YCH Group totalling more than 280,000 sqm of GFA and an estimated value of S$400m. So, if Keppel DC REIT's unit price journey is any guide, EC World could well prove to be a bargain buy at the current level. And, compared to other yield instruments, EC World is looking attractive as the chart below shows.  |

Investor: Is the 8.4% dividend yield sustainable? I understand there is currently a 100% payout while other REITs pay out 90%.

Mr Li Jinbo: In Singapore, every REIT has paid out 100% in their first two years after IPO to reward unit holders. Normally, after that, REITs will withhold a couple of percent typically for capex to enhance the properties.

EC World's properties are generally new, so we are still paying out 100%. Don't rule out the possibility that we will pay between 90% and 100% some time in the future. But if we make earnings-accretive acquisitions, we will be able to generate more distributable income.

(For more info on the REIT, including the risks, read the SooChow CSSD Capital Markets initiation report)