This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 15 December 2017. The article is republished with permission.

This article by Jennifer Tan (left, Director, Research & Products, Equities & Fixed Income, at the Singapore Exchange) was published in SGX's kopi-C: the Company brew series on 15 December 2017. The article is republished with permission.

|

David Snyder is an adventurous foodie, whose willingness to savour new and different cuisines reflects his characteristics beyond the dining table.

The 46-year-old attributes his love for Asian cuisine to having been born in Singapore, and studying in the Singapore American School from 1980 to 1989, where he was immersed in a melting pot of cultures. |

Stable Cash Flows

The REIT, which listed on SGX Mainboard on 9 November 2017, is the second US-focused office REIT on Singapore Exchange. It has an initial portfolio of 11 freehold office properties in seven key growth markets in the US, with an aggregate net lettable area (NLA) of over 3.2 million square feet, and an appraised value of nearly US$830 million.

The properties comprise central business district (CBD) and suburban office buildings located in the West Coast (Seattle, Sacramento), Central Region (Houston, Austin, Denver), and East Coast (Atlanta, Orlando).

The portfolio enjoys a high committed occupancy rate of 90% and a stable lease expiry profile of 3.7 years, with no single year having more than 20% of total leases expiring. This ensures stable cash flows for the REIT.

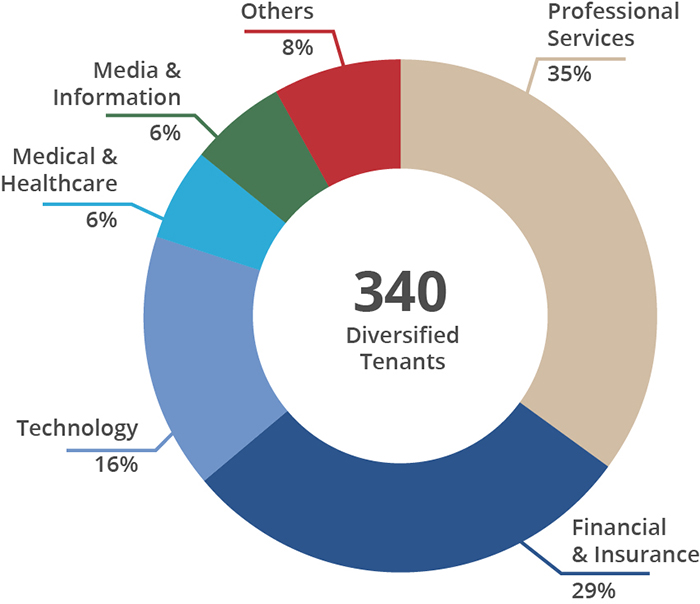

Breakdown of tenancy by trade sectors as at 30 September 2017. (Graphic: Company)With a current market capitalisation of about US$560 million, Keppel-KBS US REIT has gained about 1.1% from its initial public offer (IPO) price of US$0.88 per share.

Breakdown of tenancy by trade sectors as at 30 September 2017. (Graphic: Company)With a current market capitalisation of about US$560 million, Keppel-KBS US REIT has gained about 1.1% from its initial public offer (IPO) price of US$0.88 per share.

Based on its offer price, the REIT offers a distribution yield of 6.8% in Forecast Year (January-December) 2018 and an expected distribution yield growth of 5.8% in Projection Year 2019.

Keppel-KBS US REIT's policy is to pay out 100% of its annual distributable income for the period from the listing date to end of Projection Year 2019. The trust will distribute at least 90% of its annual distributable income on a semi-annual basis after that.

The REIT is backed by two reputable Sponsors - Keppel Capital Holdings Pte Ltd, the asset management arm of Keppel Corporation, and KBS Pacific Advisors Pte Ltd - both of whom have strong expertise in fund management and commercial real estate. KBS has more than US$11 billion in assets under management (AUM), and was ranked the 11th largest US owner of office properties globally by National Real Estate Investor as at end-2016.

Favourable Trends Favourable Trends |

||||||||||||||

|

Looking ahead, prospects for the markets that the REIT invests in and is targeting remain bright, Snyder noted.

Such up and coming cities have food, music, sports and cultural trends that have sparked the migration of segments of the population, particularly the young, mobile and educated workforce. |

||||||||||||||

Competitive Edge

In terms of organic growth, the REIT will focus on bringing in the right tenants and managing occupancies at optimal levels. "Our portfolio offers diversity in terms of asset location - suburban and CBD - as well as across tenants and industries," Snyder said.

The REIT's portfolio has a varied base of 340 tenants, led by those in defensive and growth sectors such as technology, financial, professional services, and healthcare.

Yield growth for the REIT is driven by built-in rental escalations ranging from 2% to 3% for approximately 97.5% of the leases in its portfolio. There are opportunities to renew expiring leases at higher market rates for positive rental reversion, as well as growing occupancy levels by adopting a proactive leasing strategy.

While occupancy levels for commercial properties in Singapore run as high as 95% or 100%, those in the US usually range between 92% and 95%, Snyder pointed out.

KBS already has boots on the ground and can assist us in obtaining assets of choice, such as suburban properties, which are located in great neighborhoods or near malls, and cater to tenants who do not want a daily city commute. KBS already has boots on the ground and can assist us in obtaining assets of choice, such as suburban properties, which are located in great neighborhoods or near malls, and cater to tenants who do not want a daily city commute.- David Synder |

"At these levels, the occupancy rates are high enough to drive rentals, and still offer room for tenants who want to expand operations and increase their space."

Snyder believes the REIT Manager's joint-venture structure adds a strong competitive edge.

"The Keppel-KBS partnership enhances the expertise of both parties - Keppel has financial capabilities and experience with Asian investors and capital markets, while KBS brings along a deep knowledge and understanding of the US real estate market."

KBS also offers its particular brand of "magic". The firm provides opportunistic and value-added enhancements for assets that have low occupancy rates, and/or not being well-managed. "Basically, it gets properties ready so they can be leased out more easily," he added.

Apart from managing the day-to-day operations of the REIT, Snyder is focused on building trust, loyalty, and camaraderie within the team. "One individual does not a successful organization make, and I prefer to focus on the team rather than on me."

The father of two boys and two girls aged 11 to 18 constantly emphasizes the need for honesty and integrity. "I always tell my kids they must stand up for what's right, even when it's hard. Building a reputation for integrity is difficult, and can be lost in an instant."

Another imperative is treating others with respect and kindness. "My dad taught me to take responsibility, but give away the credit - we should treat people as equals and better than ourselves," he added.

"More importantly, a smile and a kind word will always go a long way."

Financial results

| Year ended 31 December (US$ '000) |

2016 | 2015 | 2014 |

| Gross revenue | 80,073 | 75,075 | 68,944 |

| Net property income | 44,593 | 41,036 | 36,718 |

| Net profit after tax and fair value change | 18,302 | 13,495 | 5,542 |

| Half-year ended 30 Jun (US$ '000) |

1HFY2017 | 1HFY2016 |

yoy chg |

| Gross revenue | 42,299 | 38,986 | 8.5% |

| Net property income | 24242 | 21600 | 12.2% |

| Net profit after tax and fair value change | 11,827 | 8,778 | 34.7% |

Source: Company data

| Outlook & Risks | ||

|

||

Keppel-KBS US REIT

Keppel-KBS US REIT offers investors the opportunity to gain exposure to the office real estate sector in key growth markets of the United States. The REIT aims to provide unitholders with attractive total returns, driven by regular and stable distributions. Its portfolio consists of 11 high quality commercial real estate properties, with a combined aggregate net lettable area of approximately 3.2 million sq ft. These properties are located in key growth markets in the West Coast (Seattle and Sacramento), Central Region (Denver, Austin and Houston) and East Coast (Atlanta and Orlando). The REIT's diversified tenant base is led by those in growth and defensive sectors, such as technology, finance and insurance, professional services, as well as medical and healthcare. With stable and well-spread lease expiries, the REIT is well-positioned to enjoy stable cash flows in the long term.

Keppel-KBS US REIT is backed by two reputable Sponsors - Keppel Capital Holdings Pte Ltd and KBS Pacific Advisors Pte Ltd. A premier asset manager in Asia, Keppel Capital is the asset management arm of Keppel Corporation Ltd. Keppel Capital has approximately S$28 billion in assets under management through 11 funds - two SGX-listed REITs, Keppel REIT and Keppel DC REIT; one SGX-listed business trust, Keppel Infrastructure Trust; and eight private funds managed by Alpha Investment Partners Ltd.

Incorporated in Singapore, KPA is owned by shareholders who also hold stakes in KBS Capital Advisors LLC, a US premier commercial real estate investment manager that has completed more than US$33 billion of transaction volumes since its inception in 1992. Managing over US$11.4 billion in AUM, KBS was ranked the 11th largest US owner of office properties globally, with a portfolio comprising more than 41.8 million sq ft of NLA and a presence in over 30 markets in the US.

For the IPO prospectus, click here.

The company website is: www.kepkbsusreit.com.

The ccompany's Stock Facts page is here.