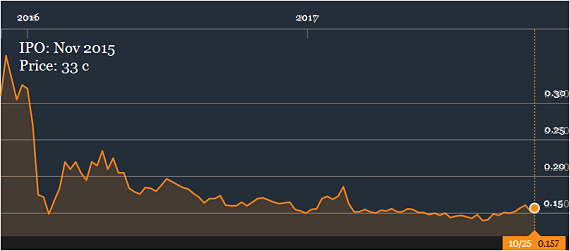

| Looking at the chart below, one concludes that the stock has been getting little love from the market for quite some time. That's the disappointing experience The Trendlines Group -- which invests in and incubates innovation-based medical and agricultural technologies -- has been through since its IPO on the Singapore Exchange in Nov 2015.  Trendlines' stock (15.9 cents) is currently down by about half from its IPO price. Chart: Bloomberg Trendlines' stock (15.9 cents) is currently down by about half from its IPO price. Chart: Bloomberg |

A change of heart towards Israel-based Trendlines may yet happen in the broader market now that some Singapore funds, with recognisable names, have shown their confidence in the company.  Terence Wong, CEO of Azure Capital and ex-research head at RHB. Funds which subscribed to a placement of its new shares which was completed this week included: Asdew Acquisitions (headed by Alan Wang), Azure Capital (Terence Wong) and Lumiere Capital (Victor Khoo and Wong Yu Liang).

Terence Wong, CEO of Azure Capital and ex-research head at RHB. Funds which subscribed to a placement of its new shares which was completed this week included: Asdew Acquisitions (headed by Alan Wang), Azure Capital (Terence Wong) and Lumiere Capital (Victor Khoo and Wong Yu Liang).

Others included Island Asset Management, ICH Capital, and Emerald Investment Management.

To its credit, since its IPO, Trendlines Group has been highly active in investor relations activities, and its business has made substantial progress.

All that would not have escaped the notice of some investors, including Trendlines' IPO cornerstone investor, B. Braun Melsungen AG.

All in, they and other investors subscribed for a total of S$14.03 million worth of placement shares (ie 100 million shares at 14.03 cents apiece).

They would have noted, among other things, a welcome development on the horizon -- which was alluded to in Wednesday's press release on the completion of the share placement.

It said, very briefly, that Trendlines is considering "the possible implementation of a dividend policy".

The topic of dividend had also cropped up in Trendlines' answers to FAQs on 12 June 2017, where it said: "We aspire to pay dividends in the future."

Now, anyone with the slightest familiarity with Trendlines' financials may question how the company can pay a dividend when, among other things, its cash pile has been shrinking as it invests in its portfolio companies.

The answer, to those who have tracked Trendlines closely, lies within two announcements the company has made:

♦ Q&A on page 3 of 7 Aug 2017 announcement, and

♦ Announcement on 12 June 2017.

The answer, in brief, is likely to be: a royalty stream from the commercialisation of a product. That stream has a net present value of US$43.8 million over an unspecified number of years. (See: TRENDLINES GROUP: Royalty payments to stream in from 1H2018)

Trendlines' dividends could also be supported by cash its raises from exits from portfolio companies. Typically, exits result in a few million dollars of cashflow but once in a long while, a mega exit happens.

Information on the potential size and timing will have to wait, as CEO Todd Dollinger would only say towards the end of Wednesday's press release: "... we are working on moving certain portfolio companies toward exit transactions.”

With the placement completed, and as announced on 10 October 2017, the Group is conducting a strategic review in respect of its operations. The scope of the review includes the portfolio held by the Group and the operation of its business with a view to reduce costs, increase efficiency and enhance shareholder value, including the possible implementation of a dividend policy. With the placement completed, and as announced on 10 October 2017, the Group is conducting a strategic review in respect of its operations. The scope of the review includes the portfolio held by the Group and the operation of its business with a view to reduce costs, increase efficiency and enhance shareholder value, including the possible implementation of a dividend policy.-- Trendlines press release (25 Oct 2017). |

So there are positive developments in the making in addition to a variety of ongoing business growth measures. Will the market quickly warm up to Trendlines?

Watch this video to gain insights into Trendlines's business of creating and developing companies to improve the human condition-->