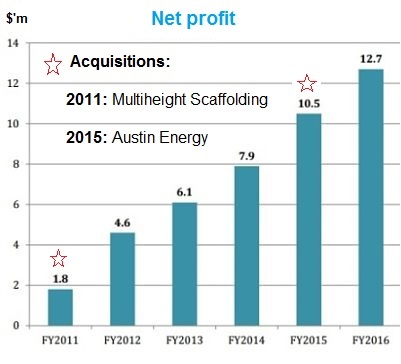

In 2016, Nordic achieved its highest profit since its listing in 2010. Given its strong cashflow, it has a policy of paying out 40% of its earnings as dividends.1. Nordic has grown its net profit by roughly $2 million a year in the past five years (see chart).

In 2016, Nordic achieved its highest profit since its listing in 2010. Given its strong cashflow, it has a policy of paying out 40% of its earnings as dividends.1. Nordic has grown its net profit by roughly $2 million a year in the past five years (see chart).

In percentage terms, the rate was 21% in 2016 -- and it was much higher in previous years on relatively lower earnings base.

2. Given its track record, and a commitment to try to grow its earnings 20% a year (more on this later), what PE multiple would it be fair for its stock to trade up to?

That question was the subject of some discussion at the FY2016 results briefing.

Nordic chairman Chang Yeh Hong ventured "15X". An attendee upped it to "at least 15X PE". Chang Yeh Hong, executive chairman of Nordic Group, at FY2016 results briefing.

Chang Yeh Hong, executive chairman of Nordic Group, at FY2016 results briefing.

Photo by Leong Chan Teik These are defensible numbers, going by norms of valuation which consider a fair PE multiple to be equal that to a business' growth rate -- in which case Nordic could justifiably be valued at 20X PE. (Read articles such as this CFA Institute article)

At 15X last year's earnings per share of 3.2 cents, the stock price of Nordic would be 48 cents.

That means the current stock price of 31.5 cents is undervalued by 34%.

3. Nordic's senior management is "committed to putting in place pillars and building blocks to try to grow at 20% a year," said Mr Chang.

4. There was a pocket of weakness in Nordic's 2016 results. Revenue from maintenance services dipped 24% and 1% in 4Q2016 and full year 2016, respectively.

But this year, the segment is expected to make a comeback because of the scheduled once-in-two-years major maintenance of several plants of its petrochemical clients.

5. Maintenance services (scaffolding and insulation services), which are contracted at unit rates, are not reflected in Nordic's order book which refers only to "projects".

This order book has dropped from $39.2 million as at end-2015 to $21.6 million as at end-Jan 2017. But Mr Chang said he is optimistic that it may be topped up in due course.

6. Nordic's business segment that serves the marine, oil & gas clients has faced significant challenges because of a slump in the shipping industry and in the price of oil.

It, however, has seen initial success in applying its capabilities in specialised automation and software to other industries, having completed projects for a hospital, Changi Airport and a chemical plant. (See slides 22 and 23 of Powerpoint presentation)

Look out for more growth through this diversification strategy. In addition, Nordic is constantly evaluating M&A opportunities to give it a new level of sustainable earnings growth.

|

Stock price |

31.5 c |

|

52-week range |

17.4 – 35.5 c |

|

PE (ttm) |

9.6 |

|

Market cap |

S$124 m |

|

Shares outstanding |

393 m |

|

Dividend yield |

4.0% |

|

Year-to-date return |

26% |

|

Source: Bloomberg |

|

7. In January 2017, for the first time, Nordic invested in a financial instrument in China's nascent carbon trading market. Giving a run-down of the scheme, Mr Chang also assured investors that the risks are manageable and the potential upside looks good.

Nordic's Powerpoint presentation has seven slides on the topic.

There was much discussion and debate on the investment, which is too lengthy and technical for this article. The good news is, a small portion of the investment has realised undisclosed gains already.