Best World is a leading direct seller of premium skincare, health supplements and wellness products, such as its best-selling DR's Secret skincare range. (Photo: Company) Best World is a leading direct seller of premium skincare, health supplements and wellness products, such as its best-selling DR's Secret skincare range. (Photo: Company)

BEST WORLD INTERNATIONAL has emerged as a top gainer on SGX in the past year (if you exclude the 2,000% gain of ISR Capital which is under probe).

China is the world's second largest direct-selling market, worth US$35.5 billion in 2015 and growing at 19% per annum. |

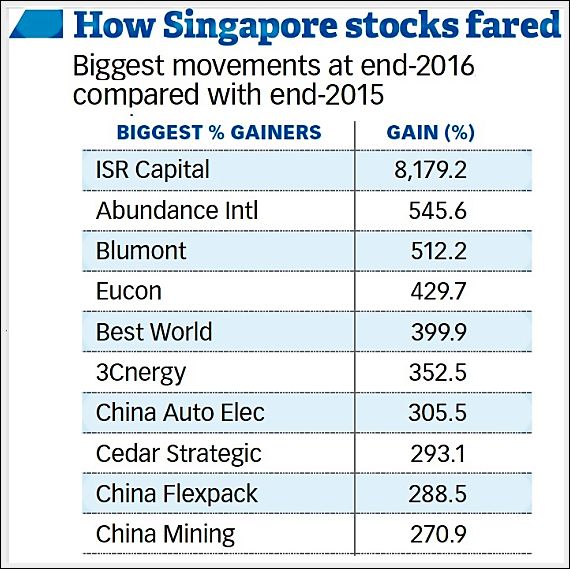

The tables below show the top 20 gainers and losers of 2016. Top gainers with a PE ratio of less than 15 times are highlighted.

| Top 20 Gainers |

Total Return | Stock Price (end-2016) |

PE |

| BEST WORLD | 416% | $1.34 | 14.0 |

| MERCURIUS CAPITAL | 200% | 3c | - |

| S I2I | 196.8% | 174c | 4.3 |

| CITYNEON | 195.3% | 94.5c | 30.4 |

| AEM HOLDINGS | 195.3% | 86c | 4.7 |

| SING MEDICAL GROUP | 166.9% | 43.5c | 169.0 |

| CHINA KANGDA FOOD | 159.1% | 28.5c | - |

| EQUATION SUMMIT | 140% | 1.2c | - |

| JASPER INVESTMENT | 137.5% | 1.9c | 726 |

| CNMC GOLDMINE | 136.8% | 43.5c | 8.5 |

| TSH CORP | 133.4% | 2.8c | - |

| CWG INTERNATIONAL | 127.8% | 16.4c | - |

| MM2 ASIA | 126.1% | 45.5c | 56.4 |

| ALLIED TECH | 120% | 2.2c | -- |

| KODA | 114.5% | 82c | 8.4 |

| FOOD EMPIRE | 114.3% | 45c | 19.6 |

| 800 SUPER | 107.2% | 96.5c | 10.3 |

| CHINA AVIATION | 105.5% | 140c | 10.1 |

| GSH CORP | 104.4% | 51c | 157.3 |

| CHINA FLEXIBLE | 101.2% | 75.5c | - |

| Top 20 Losers |

Total Return | Stock Price | PE |

| SERRANO | -96.9 | 0.2c | - |

| SWEE HONG | -92.9 | 0.9c | 3.0 |

| OKH GLOBAL | -91.0 | 6c | 3.2 |

| KOYO INTERNATIONAL | -83.9 | 5.9c | 19.6 |

| UNITED FOOD | -81.5 | 2.8c | - |

| A-SONIC AEROSPACE | -81.1 | 17.3c | - |

| INFORMATICS | -80.0 | 15.2c | - |

| STRATECH GROUP | -78.0 | 8.8c | - |

| USP GROUP | -77.2 | 9.8c | 0.8 |

| NICO STEEL | -76.7 | 1.4c | - |

| DRAGON GROUP | -75.4 | 1.4c | - |

| MARCO POLO MARINE | -75.2 | 5.2c | - |

| TRANSCORP | -75.2 | 3.3c | - |

| MAGNUS ENERGY | -75.0 | 0.1c | - |

| MMP RESOURCES | -75.0 | 0.3c | - |

| FAR EAST GROUP | -75.0 | 3.5c | - |

| LERENO BIO-CHEM | -71.4 | 2c | - |

| LIONGOLD CORP | -71.4 | 0.2c | - |

| AUSGROUP | -70.7 | 4.6c | - |

| GAYLIN | -69.8 | 12.4c | - |

The above total return data from Bloomberg includes capital adjustments and dividends over the year to 30 Dec 2016.  The Business Times last Saturday published its version of top gainers some of whose figures are very incorrect.

The Business Times last Saturday published its version of top gainers some of whose figures are very incorrect.

The BT table (left) showed ISR Capital as the top gainer with 8,179% gain.

But from 0.6 cent to 12.7 cents is actually about 2,000%. (The stock has been suspended since late Nov and is under a cloud ).

Eucon, to which BT ascribed a gain of about 430%, actually had a negative return of 7% (from 3 cents to 2.8 cents).

Did Blumont turn in a 512% gain?

Nope, it was minus 33%. And Abundance International's gain was nowhere near as abundant as reported.