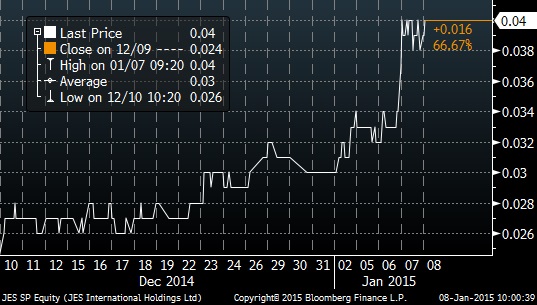

JES' stock price has surged more than 60% over the past months, thanks to the recent rally on China stocks, as well as its recent re-entry to the PRC white list for approved shipyards. Bloomberg data

JES' stock price has surged more than 60% over the past months, thanks to the recent rally on China stocks, as well as its recent re-entry to the PRC white list for approved shipyards. Bloomberg dataJES INTERNATIONAL HOLDINGS' stock price has surged by 27% over the past few trading days to 3.8 cents yesterday (Wednesday), buoyed by investor enthusiasm on its re-entry into the white list of shipyards approved by the PRC Ministry of Industry and Information.

On 31 December, the Ministry published the names of 10 shipyards that were added to the existing white list of 50.

Being on the white list ensures that shipbuilding projects undertaken will receive priority treatment for ship financing from PRC banks.

JES Executive Chairman Jin Xin. Photo: CompanyFor both ship-owners and shipyards, the means to finance the construction of multi-million dollar maritime vessels is critical to survival in the highly challenging marine transportation business.

JES Executive Chairman Jin Xin. Photo: CompanyFor both ship-owners and shipyards, the means to finance the construction of multi-million dollar maritime vessels is critical to survival in the highly challenging marine transportation business.This development has become a life line for large loss-making shipyards.

China Rongsheng Heavy Industries, which was China's largest privately owned shipyard in its hey day, is also on the white list.

Rongsheng posted net losses in 4 out of the past seven reported financial years. Analysts expect it to incur close to Rmb 2 billion of net loss for FY2014.

Buoyed by the recent run on China plays and renewed interest in beneficiary yards, Rongsheng's stock price also surged by more than 30% since 31 December.

Both Rongsheng and JES were admitted into the white list last September, but JES was subsequently dropped for undisclosed reasons.

JES was affected by vessel cancellations in an industry plagued by a vessel supply glut, but managed to reduce its 9MFY2014 net loss to Rmb 68.0 million, down 80% from a year ago.

While the admission criteria to the approved shipyard white list is stiff, the good news for JES is it the policy aims to help shipyards with sizable assets rather than just focus on those with good financial track record.

One of the policy directives is to help China's shipbuilding industry manage the vessel supply glut by reducing destructive competition.

Shipyards that show the best potential for improving China's shipbuilding standards are granted ship financing privileges.

JES' operating subsidiary that was named on the white list, Jiangsu New East Marine Equipment Co Ltd, has production facilities sitting on 800,000 square meters and a deepwater coastline of 1.8km.

Its 500,000 DWT dry dock is one of the largest in the world.

JES' dry dock is a 480m by 120m world class facility. Photo: Company

JES' dry dock is a 480m by 120m world class facility. Photo: Company

Its 500,000 DWT dry dock is one of the largest in the world.

JES' dry dock is a 480m by 120m world class facility. Photo: Company

JES' dry dock is a 480m by 120m world class facility. Photo: Company Most shipyards that do not make the white list are expected to eventually exit the industry niche.

Broadly, admission criteria for entry into the white list covered the following areas.

1) Scale and capability of physical shipbuilding facilities.

2) Modern management and operational processes usch as JIT project management, ERP systems, efficiency in energy consumption, and having a production design department.

3) Independent R&D and product innovation with a minimum threshold of 2% R&D expense ratio.

4) Suitably qualified personnel for specific key corporate departments

5) Quality management systems such as third-party ISO certification.

6) Safety, environmental protection, occupational health and social responsibility practices