|

Excerpts from Credit Suisse report by analysts Gerald Wong, CFA and Kwee Hong Ching Excerpts from Credit Suisse report by analysts Gerald Wong, CFA and Kwee Hong Ching

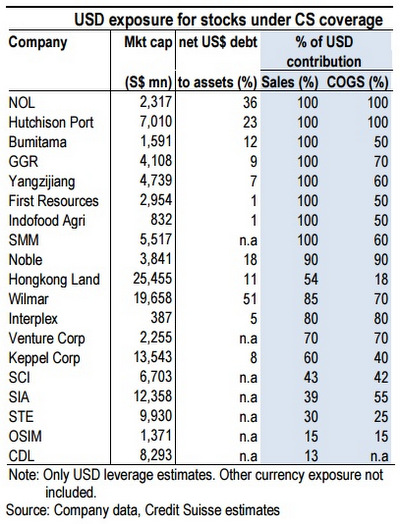

Tech, Industrials and Commodities have significant USD revenue

Cap goods:Keppel and Sembcorp Marine should be largely hedged on their order books, which limit near-term gains. The larger depreciation of currencies at other competing countries means export competitiveness may not improve much. Yangzijiang could benefit from stronger USDRMB as only about 40-50% of costs are in RMB.

Palm oil companies are beneficiaries of a stronger USD.Palm Oil: Palm oil companies are beneficiaries of a stronger USD, though the impact will be more limited for Wilmar, Golden Agri and First Resources, which report in USD. Palm oil companies are beneficiaries of a stronger USD.Palm Oil: Palm oil companies are beneficiaries of a stronger USD, though the impact will be more limited for Wilmar, Golden Agri and First Resources, which report in USD.

Tech: A stronger USD is a tailwind for top line growth in the near term. Venture's revenue grew 10% YoY in 2Q15 despite a weak demand environment as it is increasing market share and partly helped by currency.

SIA: 55% of SQ's costs are denominated in USD, while revenues generated in some of its key markets, including Europe, Japan, Australia, Indonesia, and Malaysia, have depreciated against the SGD.

Banks: DBS has c.44% USDHKD-linked loans and can see near-term translation gains.

|