Sally Chua, MD of Singapore Kitchen Equipment. NextInsight file photo.IN TACKLING A labour crunch, F&B groups are setting up central kitchens to service their outlets, a trend that Singapore Kitchen Equipment (SKE) expects to benefit from. Sally Chua, MD of Singapore Kitchen Equipment. NextInsight file photo.IN TACKLING A labour crunch, F&B groups are setting up central kitchens to service their outlets, a trend that Singapore Kitchen Equipment (SKE) expects to benefit from.SKE, which fabricates and distributes kitchen equipment for commerical entities, is pursuing consultancy work for central kitchens, said Sally Chua, its MD, at the FY2013 results briefing recently. "We are focusing hard on this area of business. "Aside from consultancy, we are bringing in automatic and semi-auto machines that our customers will get government incentives and grants for." Besides Select Group, SKE is negotiating central kitchen projects with several other food chain operators and dormitory operators. The contract value of a project could be a couple of million dollars but it varies with the specifications. The contract value is usually split among several equipment suppliers. The setting up of a large-scale central kitchen takes about 3 months. The business of setting up central kitchens will be good for another one to two years, said Ms Chua. Would overseas business contribute this year? Not yet. Ms Chua said SKE will set up a representative office in Myanmar and Cambodia this year and seek a local partner. "We chose Myanmar particularly as tourism there is booming, with more hotel developments coming up. It is therefore a huge market for us." SKE expects to derive more meaningful business scale from overseas from 2015 onwards. Singapore will still be the key market to focus on. 2014 is expected to be a more profitable year for SKE, which expects 15-20% revenue growth. |

One-Offs Dragged Down FY2013 Profit

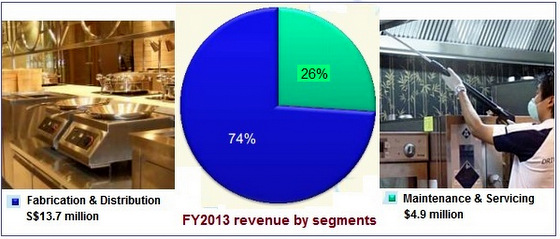

For FY13 (ended 31 Dec 2013), SKE reported a 12.4% rise in revenue to S$18.7 million. Net profit, however, fell sharply by 97% to $110,340.

Explaining that profit figure was impacted by one-offs, CFO Wong Tat Yang said in 2012, SKE enjoyed $1.6 million of gains from selling off properties while in 2013, it incurred $1.1 million of IPO-related expenses.

Adjusted for these one-off items, SKE's net profit for 2012 and 2013 were $2.2 million and $1.2 million, respectively. The difference is largely attributed to higher salaries and higher headcount.

Still, SKE proposed a 0.5-cent final dividend. Taken together with the interim dividend of 0.25-cent a share, SKE's dividend payout amounts to $1.125 million, which exceeds its net profit for the year.

The payout is its maiden one as the company was listed in 2H2013, raising $4.6 million.

"We listed the company not to get money from investors but to get a higher profile," said Ms Chua.

Here are highlights of the Q&A session involving analysts, investors and the senior management of SKE, including MD Sally Chua and CFO Wong Tat Yang, and Independent Director Eileen Tay.

Q: You said you are the market leader. What is your market share in Singapore?

A: We do not have confirmed statistics but we should have about 25% to 30% of the market. We are targeting to grow to 40-50%.

Q: Who are your close competitors?

A: We consider Fabristeel and Sommerville our competitors. Among the three of us, we are the only founders-owned company. The other two are foreign-owned.

Q: Is Kitchen Culture a competitor?

A: It is not our direct competitor as it is more focused on the residential market, although it is going into the central kitchen business. They do not have a servicing team to tap into hawker centres.

Q: How many clients do you have in total?

A: About 1008.

Q: You can double your sales with the existing production facilities in Johor?

A: There is a possibility. We are also increasing our labour strength with two production shifts in future. For night shifts, we are getting foreign workers from Vietnam and Myanmar.

Q: 2H FY2013 sales growth was flat. Is there seasonality in your business?

A: For 2012, most of the sales were congested in the last quarter as customers wanted equipment to be installed before the festive season started. Learning from that experience, we managed to deliver earlier so the result was more balanced between the first half and second half.

In terms of seasonality, previously it was 35% and 45% for 1H and 2H, respectively. Now it's about 40% (1H) and 60% (2H). First half is typically a low season.

Q: Why has the gross profit margin gone down from 39.3% to 35.2% in FY2013?

A: In fact, 39.3% was the highest in the group's history, partly because of a bulk discount we enjoyed. In the past 5 years, 30-35% was the normalised range.

The gross margin depends on the type of projects but we try to keep within the range of 30% to 35%. In addition, as we are expanding our sales team in order to gain more market share, we slightly lower our margin to win contracts.

Q: What is the projected gross profit margin for FY2014?

A: We believe we can achieve the mid 30s range. This April, we will be at the Food and Hotel Asia exhibition and with an exclusive partnership with a China distributor, I believe the gross profit margin this year should be very good.

Q: Are you still increasing the sales force?

A: Yes, we are still recruiting. They have passed their probation period and contributing to the Group’s sales.

Q: Who are the new customers?

A: They are mainly low-mid range customers, including kopitiams, for itemized sales. That's a huge market.

Q: What is your customer mix like?

A: We have about 60% to 70% mid-range and above customers . Mid- range customers are those with contract values worth between $30,000 and $70,000 but below $100,000 and/or of reputable branding.

Q: How is the net profit margin going to be like going forward?

A: We definitely need to improve our net profit. We are targeting the high single digit or low double digit margin.

A: We definitely need to improve our net profit. We are targeting the high single digit or low double digit margin.

Q: Currently, you have $8 million of cash on your balance sheet. What is your capex for FY2014?

A: We intend to expand our service fleet to increase our servicing revenue. In addition, we are looking to acquire new machinery. It is not much capex.

Q: How much will the new machines - laser machines, welding machines -- cost?

A: The machines are not more than $500,000. We are not going for German-made ones but China-made ones.

Q: You buy products from overseas in foreign currencies. In the event that the foreign exchange goes up, will you pass on the cost to your customers?

A: We would like to maintain our margin or decrease it slightly to gain market share. Since there are other suppliers, an increase in cost will also affect them. We will look into hedging FX.

Q: What is the sales percentage of your own house brand?

A: It is about 30%. We expect the percentage to increase with our increase in machinery.

Q: What will the debt level be going forward?

A: Debt level is unlikely to increase unless there is a significant increase in sales.

-- Allison Chen contributed to this article.

Recent story: S'PORE KITCHEN EQUIPMENT: High IPO Expenses But Priming For Growth