Guangdong Yueyun Transportation Chairman Mr. Liu Wei holds the "Golden Bauhinia Awards 2013 -- Listed Company with Most Growth Potential" trophy. Photo: Ta Kung PaoGUANGDONG YUEYUN wins prestigious award

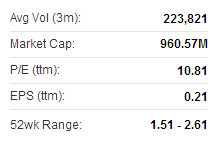

Guangdong Yueyun Transportation Chairman Mr. Liu Wei holds the "Golden Bauhinia Awards 2013 -- Listed Company with Most Growth Potential" trophy. Photo: Ta Kung PaoGUANGDONG YUEYUN wins prestigious awardGuangdong Yueyun Transportation Co Ltd (HK: 3399) won the “Listed Company with Greatest Growth Potential” honor at the Golden Bauhinia Awards 2013.

Guangdong Yueyun is principally engaged in the provision of motor vehicle transportation and auxiliary services, integrated logistics services and expressway-related services in South China.

The Golden Bauhinia Awards 2013 were hosted by the Chinese newspaper, Ta Kung Pao.

Co-organizers were The Chinese Securities Association of Hong Kong, The Hong Kong Institute of Chartered Secretaries, The Chinese Financial Association of Hong Kong, The Hong Kong Securities Professionals Association, The Listed Companies Association of Beijing, and The Shanghai Association of Stock System Enterprises.

“This award shows that our growth potential is widely acknowledged in the capital markets.

“We always attach great emphasis to the efficiency and quality of our business practices so as to achieve stable development,” said Guangdong Yueyun Chairman Mr. Liu Wei.

Yueyun recently 2.30 hkdHe added that Guangdong Yueyun will further exploit its advertising resources and optimize its business structure in an effort to gain new growth momentum and maintain its competitive edge.

Yueyun recently 2.30 hkdHe added that Guangdong Yueyun will further exploit its advertising resources and optimize its business structure in an effort to gain new growth momentum and maintain its competitive edge.“We are determined to fulfill our growth potential and realize our principal goal of becoming a conglomerate integrating road transportation, expressway services, modern logistics, commercial properties and advertising media.”

Guangdong Yueyun was founded in 1999 and listed in Hong Kong in 2005.

One Media Group and Chu Kong Shipping celebrate their 2012 tieup. From left, Luo Jian, Director & GM, Chu Kong Passenger Transport Co Ltd; Huang Shuping, Vice General Manager, Chu Kong Shipping Enterprises (Group) Co Ltd, and Patrick Lam, CEO, One Media Group Ltd.

One Media Group and Chu Kong Shipping celebrate their 2012 tieup. From left, Luo Jian, Director & GM, Chu Kong Passenger Transport Co Ltd; Huang Shuping, Vice General Manager, Chu Kong Shipping Enterprises (Group) Co Ltd, and Patrick Lam, CEO, One Media Group Ltd.

Aries Consulting file photoONE MEDIA profit down nearly 28%

One Media Group (HK: 426) saw its July-September net profit fall almost 28% year-on-year to 3.7 million hkd.

Three-month revenue slipped 10.6% year-on-year to 44.9 million hkd on slower sales.

EPS stood at 0.92 HK cent.

No interim dividend was declared.

In November 2012, One Media and South China shipping and passenger ferry play Chu Kong Shipping (HK: 560) inked a 20 million hkd deal to form Chu Kong Culture Media Co Ltd.

The joint venture targets advertising platforms within the growing passenger ferry business in the booming Pearl River Delta.

One Media’s shares are currently trading around 0.51 hkd with a 52-week range of 0.45-0.88.

One Media Group is focused on the Chinese-language lifestyle magazine market in Hong Kong and the PRC. It is principally engaged in the publication, marketing and distribution, through third party distributors, of Chinese-language lifestyle magazines and the sale of advertising space in those magazines.

See also:

YUEYUN Expands South China Footprint

ONE MEDIA Net Profit Up 10%